What Is Debt Consolidation Nj

What Is Debt Consolidation Nj Can do new jersey debt consolidation in several ways. one way involves taking out a new loan or opening a new line of credit to pay off your high interest debt. your new loan can be a personal loan, a home equity loan, refinancing your mortgage or a credit card balance transfer. another way to do debt consolidation in new jersey is with a debt. Consolidating debt with a home equity loan involves taking out a loan that is secured by the borrower’s equity in their home. the money is issued in a lump sum and the borrower can use the cash.

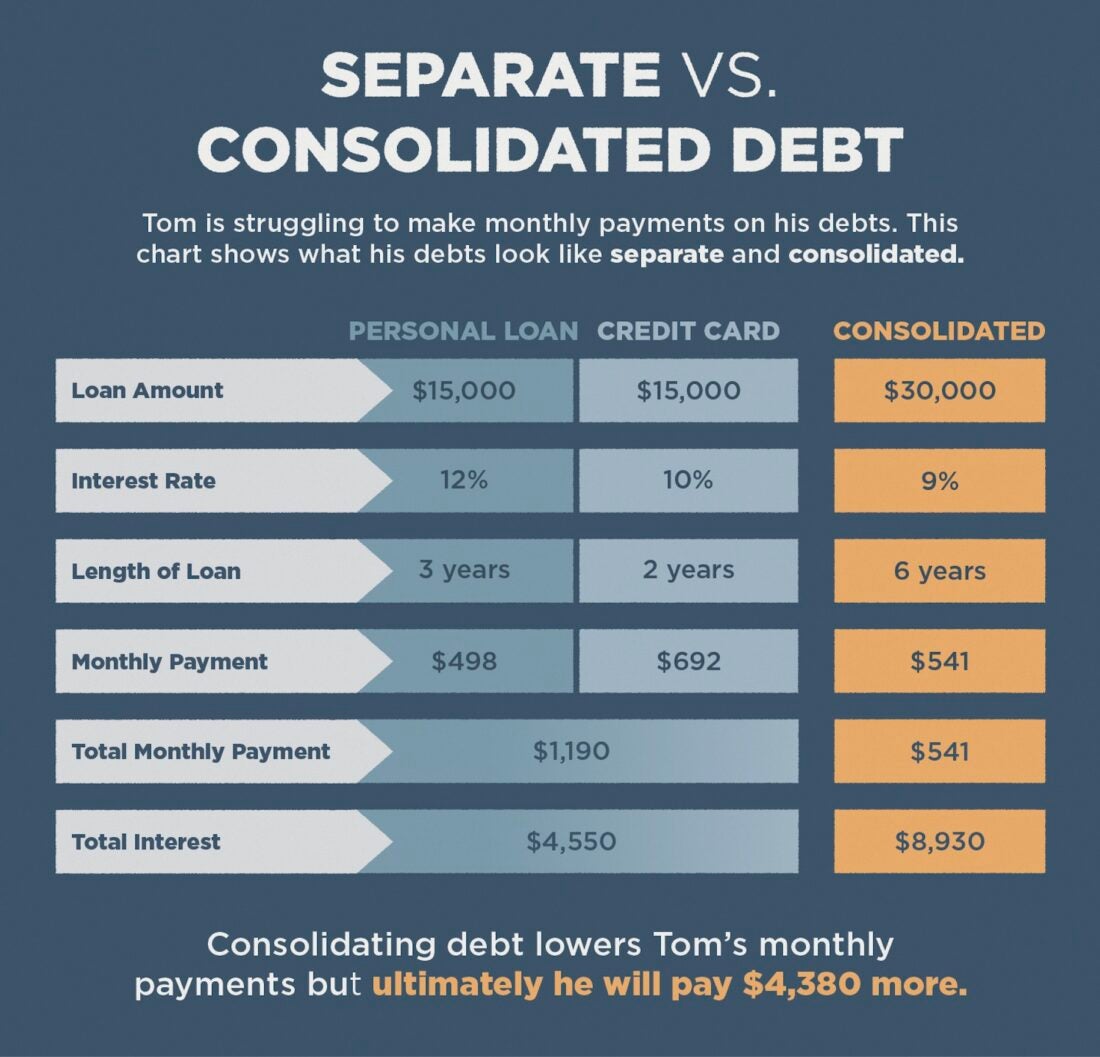

What Is A Debt Consolidation Loan And How Does It Work вђ Save My Nj Debt consolidation is the act of taking out a single loan or credit card to pay off multiple debts. the benefits of debt consolidation include a potentially lower interest rate and lower monthly. Debt consolidation allows borrowers to consolidate several debts into one loan. if you’re able to qualify for a lower interest rate, debt consolidation could save you interest while also. New jersey has an average of $8,959 credit card debt per person. if you’re a new jersey resident dealing with credit card debt, we can help you. incharge provides free credit counseling to residents of all 50 states, including new jersey. credit card debt can feel overwhelming, but there are solutions. Turbodebt. turbodebt, a debt consolidation option established in 2020, is the fastest growing debt relief company in the nation, with over $15 billion in settled debt for 500,000 clients. they offer a free initial consultation, where they work to understand your specific financial situation, and then refer you to the most appropriate debt.

Does Debt Consolidation Hurt Your Credit Nj New jersey has an average of $8,959 credit card debt per person. if you’re a new jersey resident dealing with credit card debt, we can help you. incharge provides free credit counseling to residents of all 50 states, including new jersey. credit card debt can feel overwhelming, but there are solutions. Turbodebt. turbodebt, a debt consolidation option established in 2020, is the fastest growing debt relief company in the nation, with over $15 billion in settled debt for 500,000 clients. they offer a free initial consultation, where they work to understand your specific financial situation, and then refer you to the most appropriate debt. Total debt balance: new jersey residents had a total debt balance of $62,090 by the end of 2021, well above the national average of $55,810. bankruptcies filed in 2021: 9,097 new jersey residents filed for bankruptcy in 2021, 1.15 for every 1,000 residents, ranking it 27th for per capita bankruptcies. average monthly mortgage payment: new. New jersey debt consolidation securing a debt consolidation loan is probably the least likely solution for a low income individual who is struggling to make minimum payments. this is because a debt consolidation loan is a bank loan that requires good credit.

What Is Debt Consolidation Lexington Law Total debt balance: new jersey residents had a total debt balance of $62,090 by the end of 2021, well above the national average of $55,810. bankruptcies filed in 2021: 9,097 new jersey residents filed for bankruptcy in 2021, 1.15 for every 1,000 residents, ranking it 27th for per capita bankruptcies. average monthly mortgage payment: new. New jersey debt consolidation securing a debt consolidation loan is probably the least likely solution for a low income individual who is struggling to make minimum payments. this is because a debt consolidation loan is a bank loan that requires good credit.

Comments are closed.