What Is Debt Financing

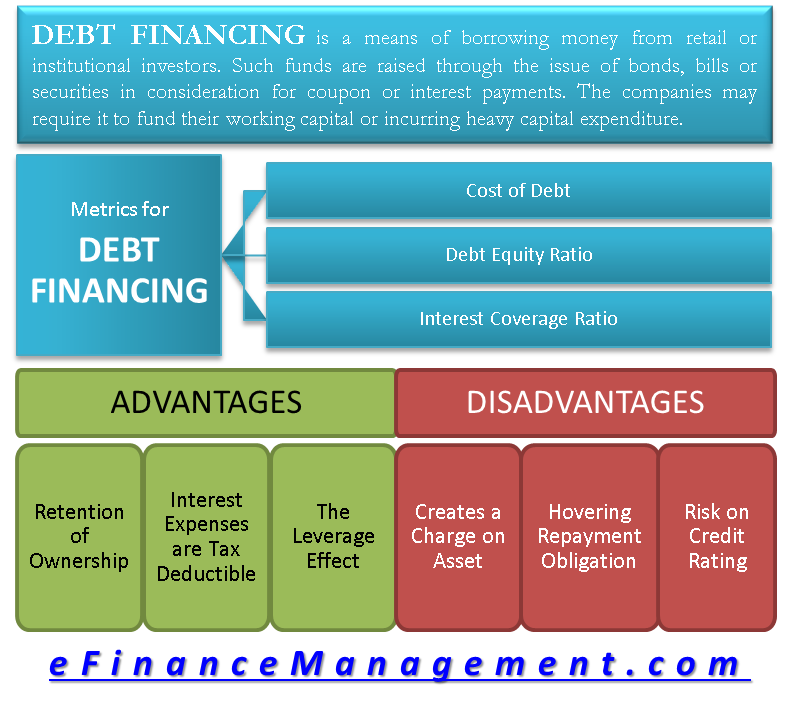

What Is Debt Financing Metrics To Analyze Advantages Disadvantages Debt financing is when a company raises money by selling debt instruments to investors, such as bonds, bills, or notes. learn how debt financing works, its advantages and disadvantages, and how to measure it with the debt to equity ratio. Debt financing is when you borrow money to fund your business and pay it back with interest. learn about the different types of debt financing, such as loans, lines of credit and cash flow loans, and their advantages and disadvantages.

What Is Debt Financing Types Comparison Example Pros Cons Debt financing is when a company borrows money from lenders and pays interest to repay the debt. learn about the types, benefits and drawbacks of debt financing, and how it differs from equity financing. Debt financing is the process of borrowing money from creditors and repaying it with interest. learn about the different types of debt financing, who provides it, and how it compares to equity financing. Debt financing is a method by which a company receives capital by borrowing money from another party and agreeing to repay it at a later date, usually with interest. although debt financing can be used by individuals (think mortgages or auto loans), it’s a term particularly associated with business lending. Learn the advantages and disadvantages of equity financing and debt financing, two types of capital raising options for businesses. equity financing involves selling a portion of ownership, while debt financing involves borrowing money and paying interest.

:max_bytes(150000):strip_icc()/debtfinancing.asp-final-fe54890987344fc4bb0120f23cb9abce.jpg)

How Debt Financing Works Examples Costs Pros Cons 2024 Debt financing is a method by which a company receives capital by borrowing money from another party and agreeing to repay it at a later date, usually with interest. although debt financing can be used by individuals (think mortgages or auto loans), it’s a term particularly associated with business lending. Learn the advantages and disadvantages of equity financing and debt financing, two types of capital raising options for businesses. equity financing involves selling a portion of ownership, while debt financing involves borrowing money and paying interest. Debt financing is a type of financing in which entities like companies obtain money by issuing debt instruments or borrowing from sources like banks. learn the meaning, types, examples, and advantages of debt financing with wallstreetmojo. Debt financing is when you borrow money to run your business. learn more about how it works and its advantages and disadvantages from the balance money, a personal finance website.

Comments are closed.