What Is Debt Financing Debt S Role In Raising Capital

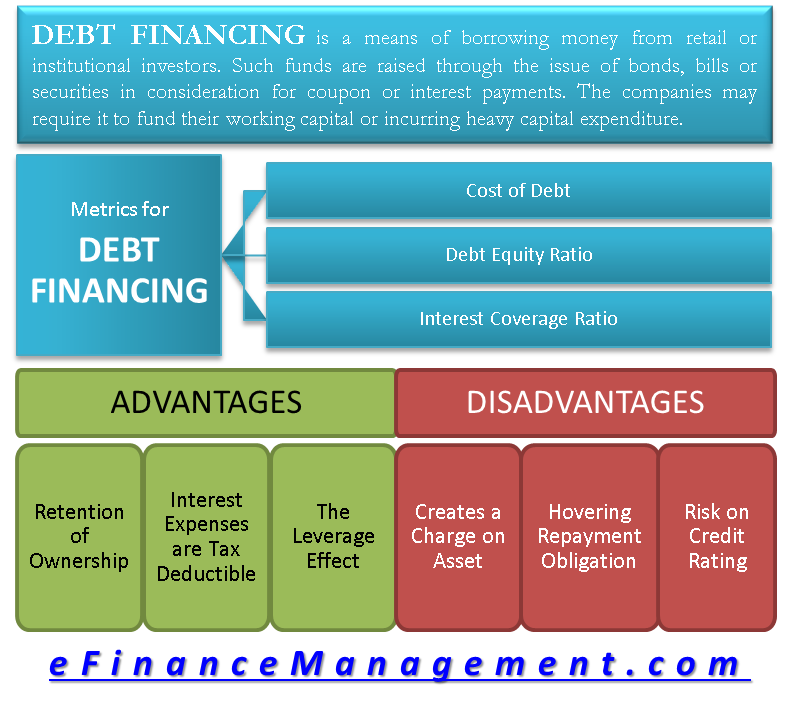

What Is Debt Financing Debt S Role In Raising Capital Debt financing is a transaction whereby a lender provides funds in exchange for a commitment to repay the lender over time with interest and, occasionally, fees. sometimes referred to as debt capital or debt funding, it is a common way for businesses to secure the money needed to fund working capital and growth. The formula for the cost of debt financing is: kd = interest expense x (1 tax rate) where kd = cost of debt. since the interest on the debt is tax deductible in most cases, the interest expense.

:max_bytes(150000):strip_icc()/debtfinancing.asp-final-fe54890987344fc4bb0120f23cb9abce.jpg)

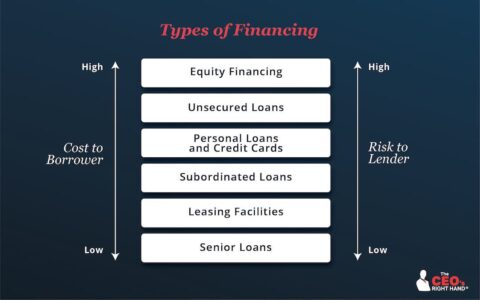

How Does Debt Financing Work Debt financing—including sba loans, credit lines, and bonds—is when companies borrow money and pay it back, typically with interest. learn how it works. startups often raise money in order to grow their businesses. there are two major ways companies obtain this capital: equity financing and debt financing. Debt financing options. 1. bank loan. a common form of debt financing is a bank loan. banks will often assess the individual financial situation of each company and offer loan sizes and interest rates accordingly. 2. bond issues. another form of debt financing is bond issues. It’s a powerful tool for businesses aiming to expand without giving up equity. understanding how it works could be the key to unlocking your company’s potential. debt financing involves borrowing funds from external sources, typically financial institutions. you’re committing to pay back the principal amount along with interest over time. There are several pros to equity financing. an equity raise requires investors to shoulder the risk, meaning the founders owe nothing if the company fails. additionally, equity is attractive.

What Is Debt Financing Metrics To Analyze Advantages Disadvantages It’s a powerful tool for businesses aiming to expand without giving up equity. understanding how it works could be the key to unlocking your company’s potential. debt financing involves borrowing funds from external sources, typically financial institutions. you’re committing to pay back the principal amount along with interest over time. There are several pros to equity financing. an equity raise requires investors to shoulder the risk, meaning the founders owe nothing if the company fails. additionally, equity is attractive. Debt financing is the process through which companies raise funds, by borrowing money from creditors such as financial institutions and investment firms. the terms of the debt financing what the funds will be used for, the duration of the loan, the interest rate charged on the loan, and more will be agreed by both parties in advance of the. To obtain this capital, company abc decides it will do so through a combination of equity financing and debt financing. for the equity financing component, it sells a 15% equity stake in its.

Debt Capital What Is It Examples Types Vs Equity Capital Debt financing is the process through which companies raise funds, by borrowing money from creditors such as financial institutions and investment firms. the terms of the debt financing what the funds will be used for, the duration of the loan, the interest rate charged on the loan, and more will be agreed by both parties in advance of the. To obtain this capital, company abc decides it will do so through a combination of equity financing and debt financing. for the equity financing component, it sells a 15% equity stake in its.

Debt Financing Meaning Example Types Advantages

Comments are closed.