What Is Equity Financing Simplified

What Is Equity Financing Simplified Youtube Equity financing is the process of raising capital through the sale of shares. both private and public companies raise money for short term needs to pay bills or long term projects by selling. Hi there! welcome to this informative video about equity financing. today, we'll explore what equity financing is and why it's an important method for raisin.

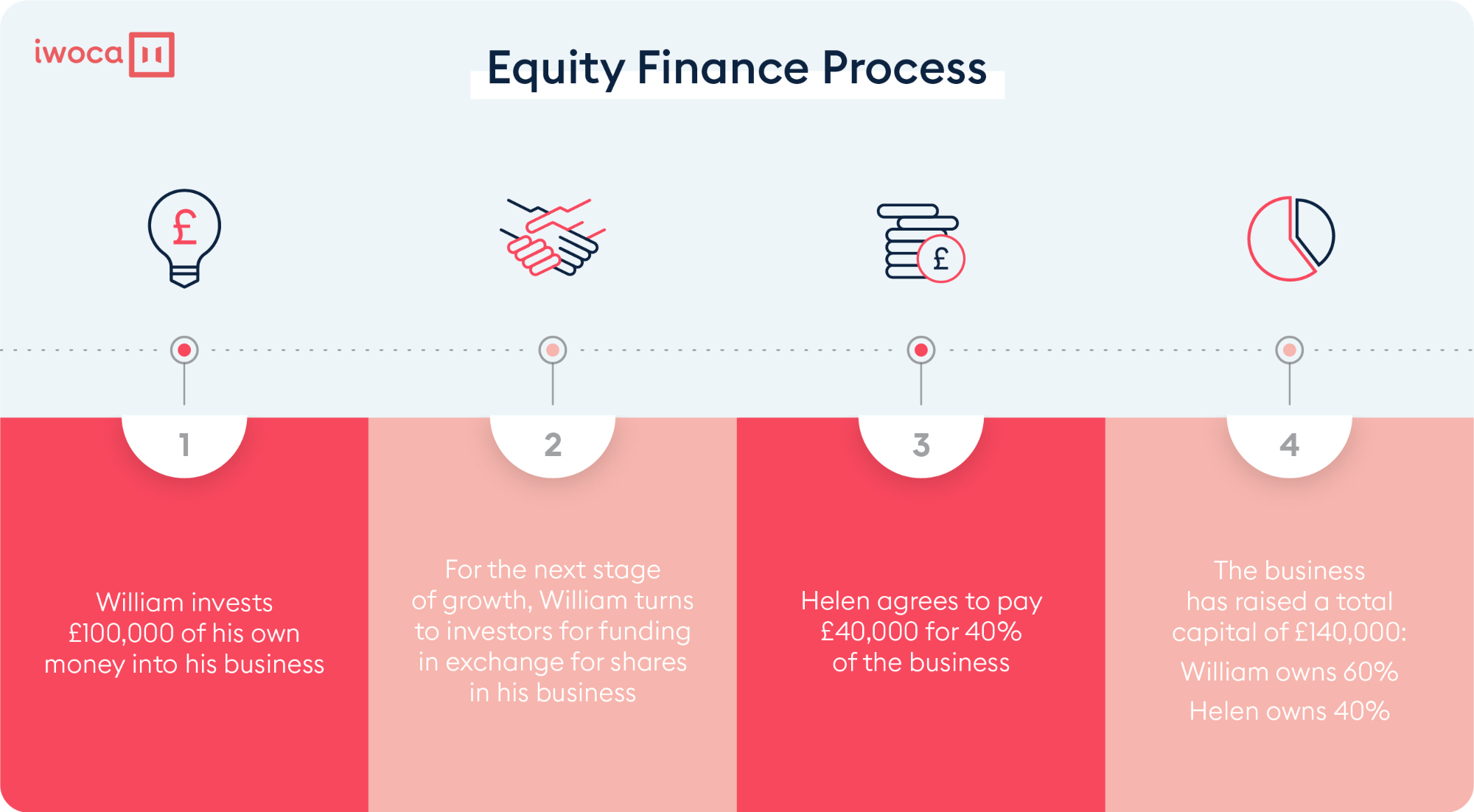

What Is Equity Financing The Different Types Of Equity Finance Iwoca Equity financing can refer to the sale of all equity instruments, such as common stock, preferred shares, share warrants, etc. equity financing is especially important during a company’s startup stage to finance plant assets and initial operating expenses. investors make gains by receiving dividends or when their shares increase in price. Equity financing involves the sale of the company's stock. a portion of the company’s ownership is given to investors in exchange for cash. that proportion depends on how much the owner has invested in the company – and what that investment is worth at the time of financing. ultimately, the final arrangement will be up to the company and. Equity financing is a way for businesses to raise capital by selling a portion of their ownership. this process involves attracting investors who contribute cash in exchange for a share of the company. this approach is commonly used by companies to fulfill both short term and long term financial needs. equity refers to the amount of capital. Equity financing involves selling a portion of a company’s equity in return for capital. for example, the owner of company abc might need to raise capital to fund business expansion.

Comments are closed.