What Is Equity Research Valuation Youtube

What Is Equity Research Valuation Youtube 📊 dive into the world of equity research with our latest educational video! 📈 in this comprehensive guide, we explore the fundamentals of equity research,. What is equity research and valuation?#technicalanalysis #forex #trading #stockmarket #forextrader #daytrading #forextrading #investing #swingtrading #stocks.

Equity Valuation Everything You Need To Know Eqvista In this session, i have covered equity research in detail, what is the role of the research desk, what work you will be doing, etc.we have also covered the s. Summary. the equity valuation models used to estimate intrinsic value—present value models, multiplier models, and asset based valuation—are widely used and serve an important purpose. the valuation models presented here are a foundation on which to base analysis and research but must be applied wisely. valuation is not simply a numerical. The role of equity research is to provide information to the market. a lack of information creates inefficiencies that result in stocks being misrepresented (whether over or undervalued). analysts. In this reading, we have discussed the scope of equity valuation, outlined the valuation process, introduced valuation concepts and models, discussed the analyst’s role and responsibilities in conducting valuation, and described the elements of an effective research report in which analysts communicate their valuation analysis.

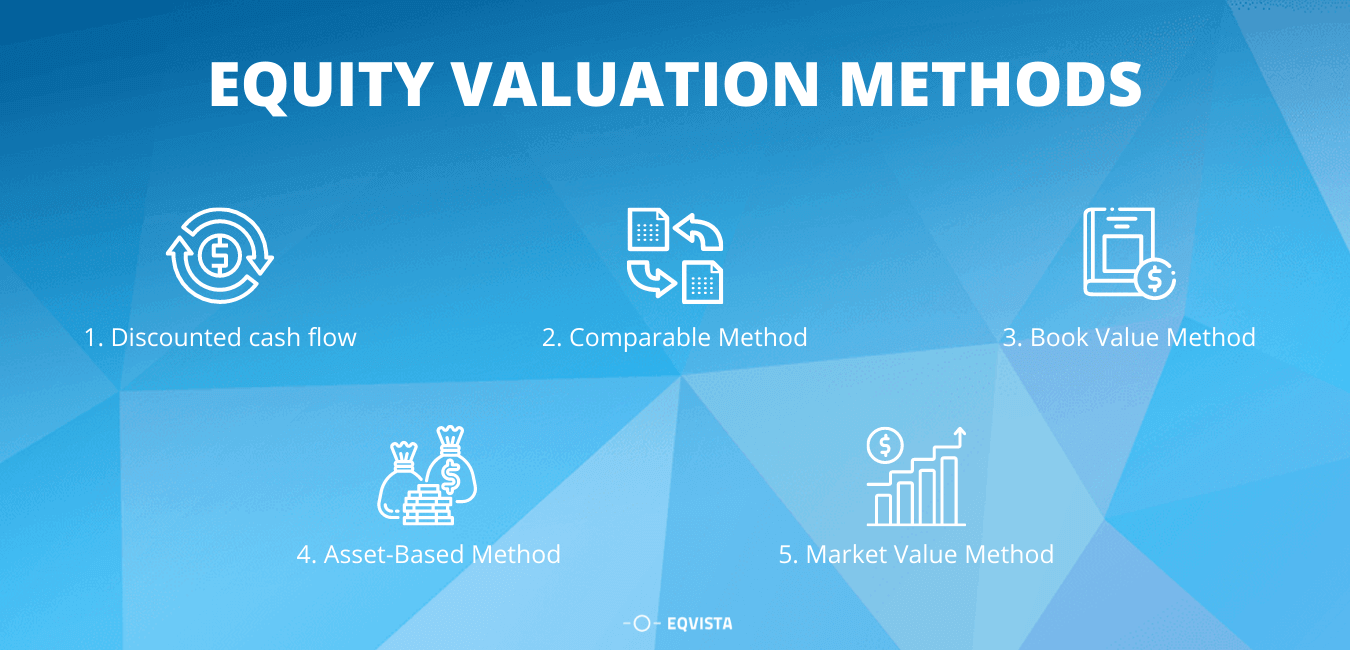

Equity Asset Valuation What Is Investment Value And How To Measure The role of equity research is to provide information to the market. a lack of information creates inefficiencies that result in stocks being misrepresented (whether over or undervalued). analysts. In this reading, we have discussed the scope of equity valuation, outlined the valuation process, introduced valuation concepts and models, discussed the analyst’s role and responsibilities in conducting valuation, and described the elements of an effective research report in which analysts communicate their valuation analysis. The comparable model is a valuation approach that analyzes the financial performance of various companies to determine which may be overvalued or undervalued. the comparables model often utilizes. Equity valuation is a blanket term and is used to refer to all tools and techniques used by investors to find out the true value of a company’s equity. it is often seen as the most crucial element of a successful investment decision. investment banks typically have a equity research department, where research analysts produce equity research.

What Is Equity Research Overview Part 03 Wallstreetmojo Youtube The comparable model is a valuation approach that analyzes the financial performance of various companies to determine which may be overvalued or undervalued. the comparables model often utilizes. Equity valuation is a blanket term and is used to refer to all tools and techniques used by investors to find out the true value of a company’s equity. it is often seen as the most crucial element of a successful investment decision. investment banks typically have a equity research department, where research analysts produce equity research.

Session 8 Introduction To Equity Valuation Youtube

Comments are closed.