What Is The Difference Between Flat Tax And Progressive Tax Flat Tax Vs Progressive Tax

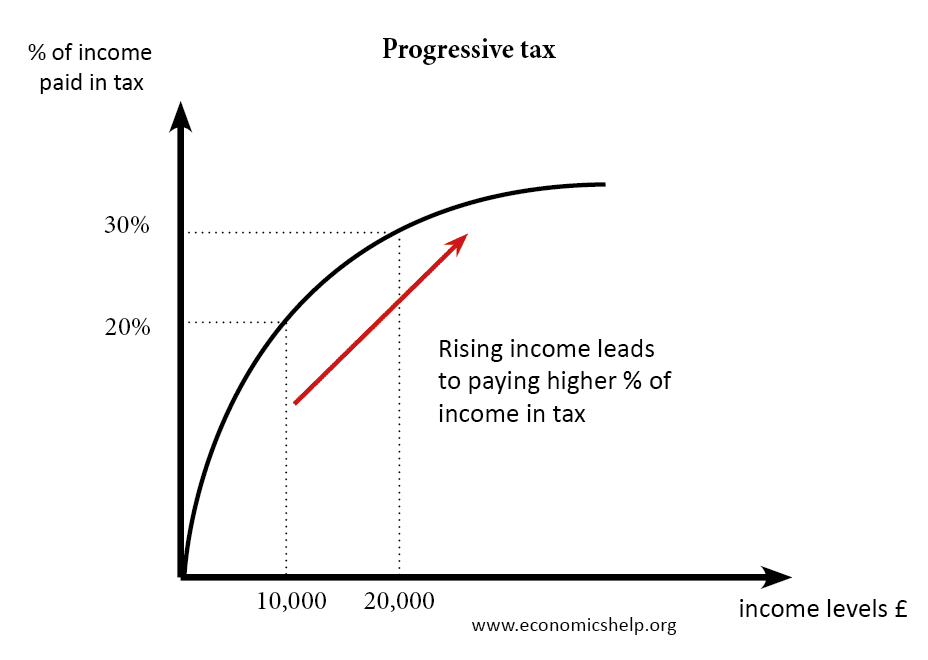

Types Of Tax In Uk Economics Help Progressive taxes are when the tax rate you pay increases as your taxable income rises. the us federal income tax is progressive, with tax brackets ranging from 10% to 37%. regressive taxes are when the average tax burden decreases as income increases. a flat tax system is a regressive tax system where everyone pays the same tax rate. A flat tax would ignore the differences between rich and poor taxpayers. some argue that flat taxes are unfair for this reason. progressive taxes, however, treat the rich and poor differently.

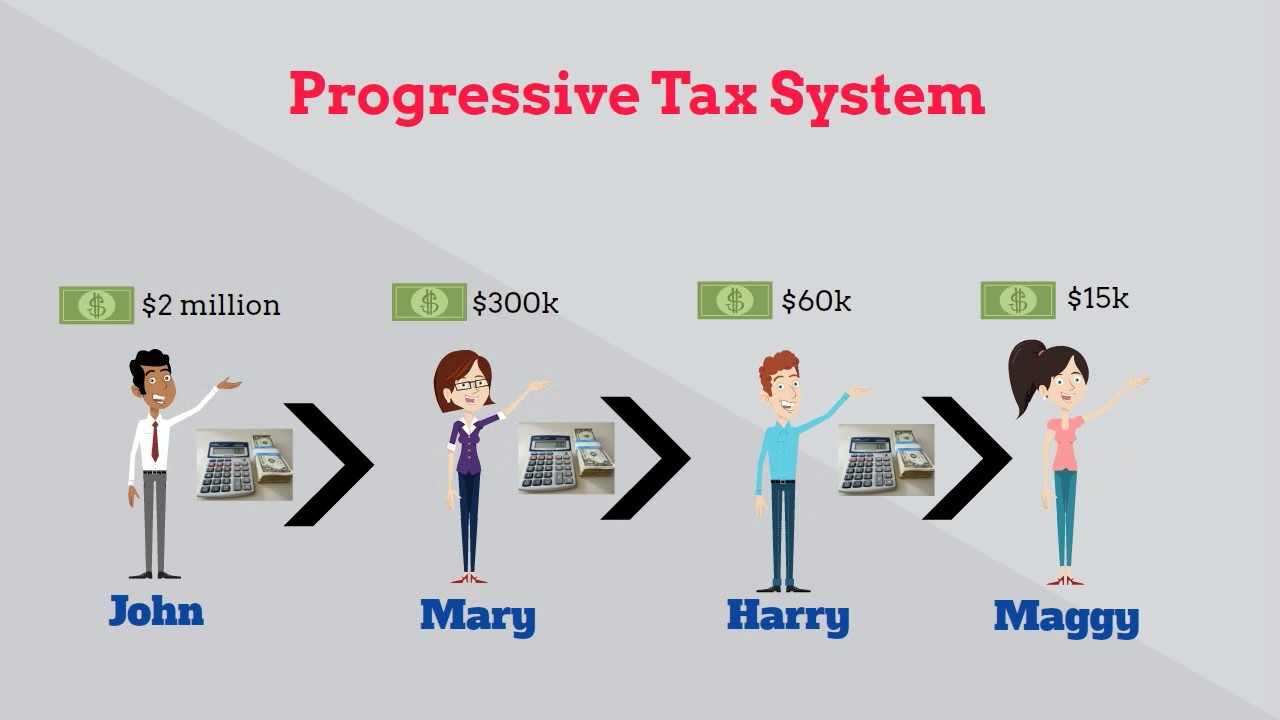

What Is Progressive Tax Youtube Income taxes operate under a progressive system in the u.s. federal progressive tax rates range from 10% to 37% in 2024. the marginal rate of taxation for a single taxpayer is: 37% on income over. Proponents of the flat tax argue that it can alleviate many of the issues associated with progressive tax systems, which often lead to complexity and loopholes that enable tax evasion. the idea of a flat tax can be traced back to the late 19th century, with american economist henry george advocating for a single land tax. Progressive tax vs. flat tax . like a regressive tax, a flat income tax system imposes the same percentage tax rate on everyone regardless of income. the federal insurance contributions act (fica. The tax for which the rate of taxation increases with increase in the base amount, is termed as progressive tax. on the other hand, the tax for which the rate of taxation is universal and does not increase with increase in base amount, is flat tax. progressive tax is based on the principle that higher the income of the individual or bigger the.

What Is The Difference Between Flat Tax And Progressive Tax F Progressive tax vs. flat tax . like a regressive tax, a flat income tax system imposes the same percentage tax rate on everyone regardless of income. the federal insurance contributions act (fica. The tax for which the rate of taxation increases with increase in the base amount, is termed as progressive tax. on the other hand, the tax for which the rate of taxation is universal and does not increase with increase in base amount, is flat tax. progressive tax is based on the principle that higher the income of the individual or bigger the. The debate between flat and progressive tax rates revolves around principles of fairness, simplicity, and economic impact. a flat tax offers simplicity and a sense of uniform fairness but may lack progressive equity. in contrast, a progressive tax system aligns with the principle of paying according to one’s means, though it can be complex. How a flat income tax works. at its core, a flat income tax system (or proportional tax) is one where everyone, regardless of whether they earn $10,000 or $10,000,000, pays the same tax rate. this may seem like a straightforward approach, but it also faces criticism. high earners, those with incomes significantly above the national average, may.

What Is The Difference Between Flat Tax Rate Vs Progressive T The debate between flat and progressive tax rates revolves around principles of fairness, simplicity, and economic impact. a flat tax offers simplicity and a sense of uniform fairness but may lack progressive equity. in contrast, a progressive tax system aligns with the principle of paying according to one’s means, though it can be complex. How a flat income tax works. at its core, a flat income tax system (or proportional tax) is one where everyone, regardless of whether they earn $10,000 or $10,000,000, pays the same tax rate. this may seem like a straightforward approach, but it also faces criticism. high earners, those with incomes significantly above the national average, may.

Progressive Tax Vs Flat Tax By Karen Hamilton

Comments are closed.