What Is The Fair Debt Collection Practices Act

Fair Debt Collection Practices Act What You Should Know The fair debt collection practices act (fdcpa) is a federal law that limits the actions of third party debt collectors who are attempting to collect debts on behalf of another person or entity. That is why congress enacted the federal fair debt collection practices act, a 1977 law that prohibits third party collection agencies from harassing, threatening and inappropriately contacting someone who owes money. u.s. debt collection agencies employ just under 130,000 people through about 4,900 agencies.

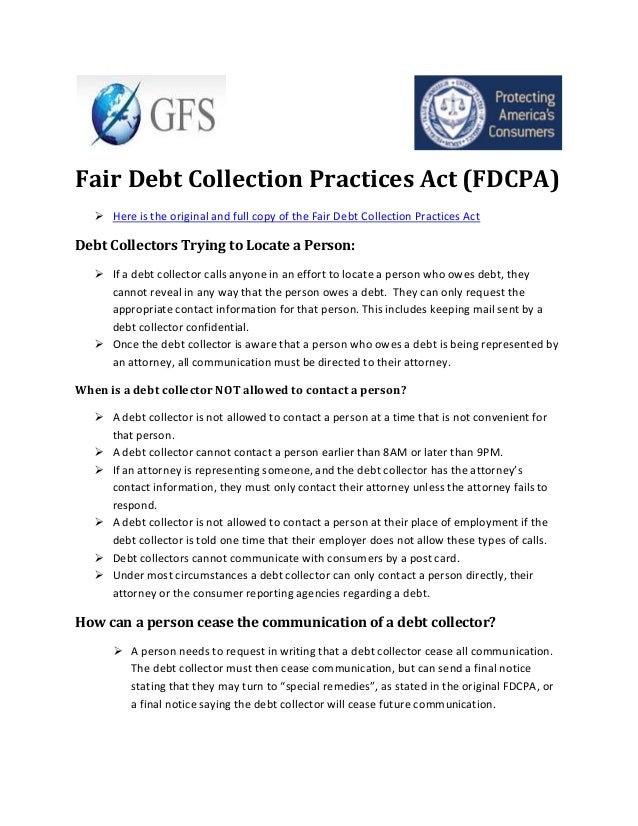

Fair Debt Collection Practices Act Fdcpa Summary Created By Goldeвђ As amended by public law 111 203, title x, 124 stat. 2092 (2010) as a public service, the staff of the federal trade commission (ftc) has prepared the following complete text of the fair debt collection practices act. §§ 1692 1692p. please note that the format of the text differs in minor ways from the u.s. code and west’s u.s. code annotated. The fair debt collection practices act (fdcpa), pub. l. 95 109; 91 stat. 874, codified as 15 u.s.c. § 1692 –1692p, approved on september 20, 1977 (and as subsequently amended), is a consumer protection amendment, establishing legal protection from abusive debt collection practices, to the consumer credit protection act, as title viii of. In some states, if you pay any amount on a time barred debt, or even promise to pay, the debt is “revived.”. that means the clock resets, and a new statute of limitations begins. the collector might be able to sue you to collect the full amount of the debt, which may include extra interest and fees. pay off the debt. The fair debt collection practices act (fdcpa) prohibits debt collectors from using abusive, unfair, or deceptive practices to collect debts from you, including: misrepresenting the nature of the debt, including the amount owed; falsely claiming that the person contacting you is an attorney; threatening to have you arrested.

The Fair Debt Collection Practices Act Explained In some states, if you pay any amount on a time barred debt, or even promise to pay, the debt is “revived.”. that means the clock resets, and a new statute of limitations begins. the collector might be able to sue you to collect the full amount of the debt, which may include extra interest and fees. pay off the debt. The fair debt collection practices act (fdcpa) prohibits debt collectors from using abusive, unfair, or deceptive practices to collect debts from you, including: misrepresenting the nature of the debt, including the amount owed; falsely claiming that the person contacting you is an attorney; threatening to have you arrested. Background. a creditor may seek to collect an outstanding debt in several ways. however, because of “abundant evidence of the use of abusive, deceptive, and unfair debt collection practices by many debt collectors,” (15 u.s.c. § 1692) congress enacted the fair debt collection practices act (fdcpa) in 1978, codified in 15 u.s. code. Under this act (title viii of the consumer credit protection act), third party debt collectors are prohibited from using deceptive or abusive conduct in the collection of consumer debts incurred for personal, family, or household purposes. such collectors may not, for example, contact debtors at odd hours, subject them to repeated telephone.

Overview Of The Fair Debt Collection Practices Act Fdcpa Background. a creditor may seek to collect an outstanding debt in several ways. however, because of “abundant evidence of the use of abusive, deceptive, and unfair debt collection practices by many debt collectors,” (15 u.s.c. § 1692) congress enacted the fair debt collection practices act (fdcpa) in 1978, codified in 15 u.s. code. Under this act (title viii of the consumer credit protection act), third party debt collectors are prohibited from using deceptive or abusive conduct in the collection of consumer debts incurred for personal, family, or household purposes. such collectors may not, for example, contact debtors at odd hours, subject them to repeated telephone.

Understanding The Fair Debt Collection Practices Act Fdcpa

Comments are closed.