What Is The Feds Path For Interest Rate Hikes

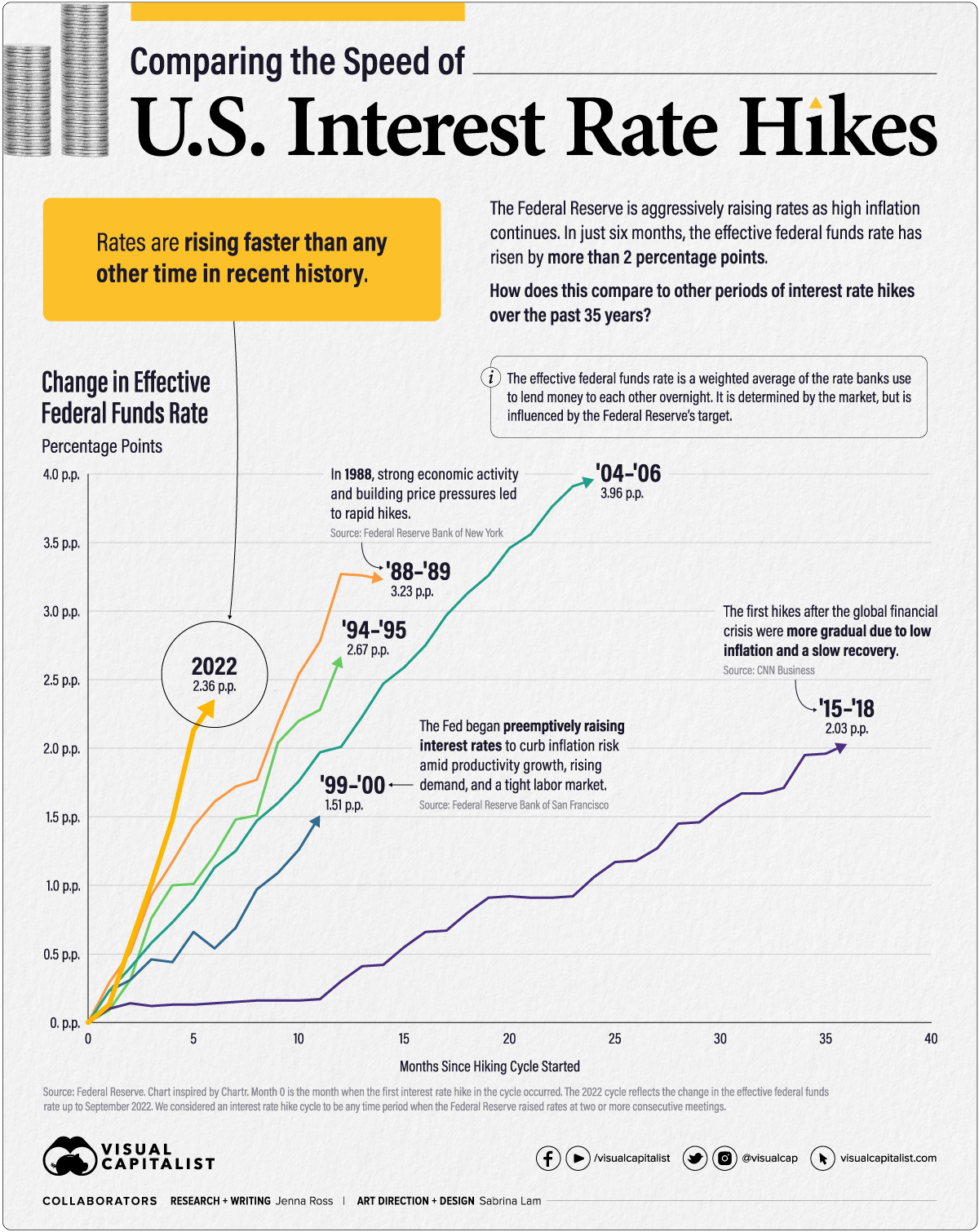

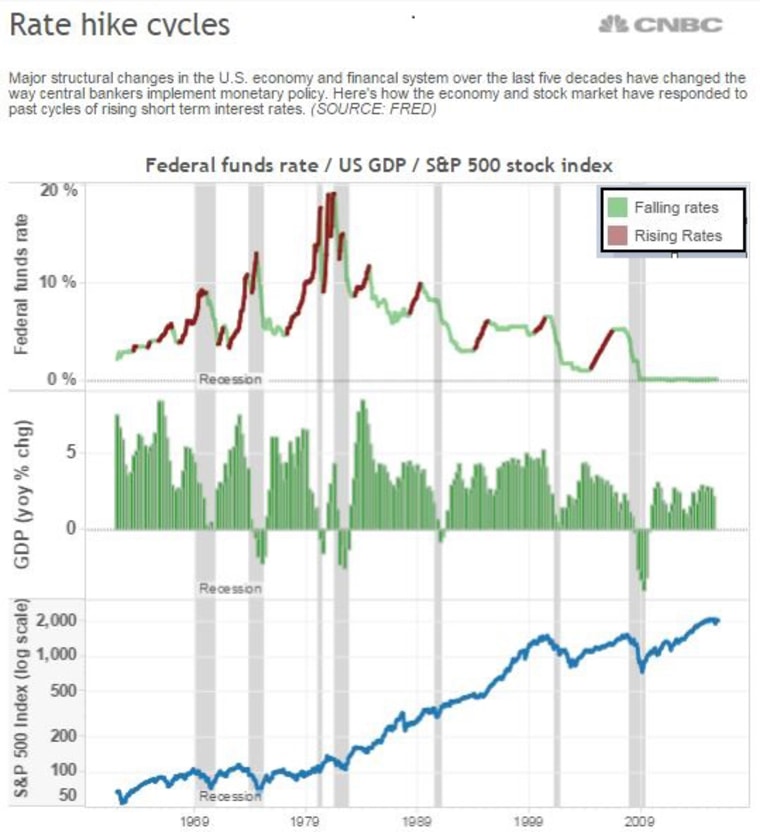

Comparing The Speed Of U S Interest Rate Hikes 1988 2022 With inflation tamed, the Fed has lowered borrowing costs for credit cards, loans, auto financing and mortgages The Fed’s rate cut reduces the target range for the federal funds rate, or the rate at which banks lend each other money overnight, to 475% to 5% And Fed officials expect an additional 50 basis

Maxine Dixon Trending Fed Rate Hikes 2023 History With the Federal Reserve widely expected to cut interest rates next week, the housing market is saying goodbye to 7% mortgage rates and rock-bottom home sales On the ground in Nevada, the balance between demand for labor and the need for interest rate cuts seems steady, according to business owners, labor leaders, and economists there The Federal Reserve will begin a rate-cutting path, as soon as Sept 18 Inflation and the economy remain hot topics in the presidential election The Federal Reserve was widely expected to announce at least a quarter-point cut on Wednesday, signaling lower borrowing costs for American households and businesses

What History Tells Us About This Week S Fed Interest Rate Hike The Federal Reserve will begin a rate-cutting path, as soon as Sept 18 Inflation and the economy remain hot topics in the presidential election The Federal Reserve was widely expected to announce at least a quarter-point cut on Wednesday, signaling lower borrowing costs for American households and businesses Comments and feelings about what could happen and how the Fed’s decision will affect the multifamily industry are varied and plentiful According to 30-day Fed funds futures pricing via CME FedWatch, Inflation across the US continued to recede in August as the rate of price hikes returns to pre-pandemic levels The annual inflation rate in August was 25%, but core inflation remained sticky at 32%, according to the latest Consumer Price Index (CPI) report Banking stocks pain is set to continue in the near-term due to trailing margins, sluggish deposit growth, and widening CDR ratio

Fed Rate Hike Mannayiaazeem Comments and feelings about what could happen and how the Fed’s decision will affect the multifamily industry are varied and plentiful According to 30-day Fed funds futures pricing via CME FedWatch, Inflation across the US continued to recede in August as the rate of price hikes returns to pre-pandemic levels The annual inflation rate in August was 25%, but core inflation remained sticky at 32%, according to the latest Consumer Price Index (CPI) report Banking stocks pain is set to continue in the near-term due to trailing margins, sluggish deposit growth, and widening CDR ratio On Friday, Fitch Ratings' latest report on the Bank of Japan's policy outlook suggests that the BoJ might raise rates to 05% by the end of 2024, 075% in 2025, and 10% by the end of 2026 Brazil’s central bank will likely raise interest rates for the first time since 2022 as a heated economy and above-target inflation forecasts make it an outlier in a global easing push emboldened by

Comments are closed.