What Is The Sga For Ssdi In 2024 Adah Mariann

2024 Ssdi Benefits And Sga Limits What You Need To Know Substantial gainful activity. to be eligible for disability benefits, a person must be unable to engage in substantial gainful activity (sga). a person who is earning more than a certain monthly amount (net of impairment related work expenses) is ordinarily considered to be engaging in sga. the amount of monthly earnings considered as sga. The monthly sga amount for non blind disabled individuals for 2024 is such sga amount for 2000 multiplied by the ratio of the national average wage index for 2022 to that for 1998, or, if larger such sga amount for 2023 ($1,470). if the amount so calculated is not a multiple of $10, we round it to the nearest multiple of $10.

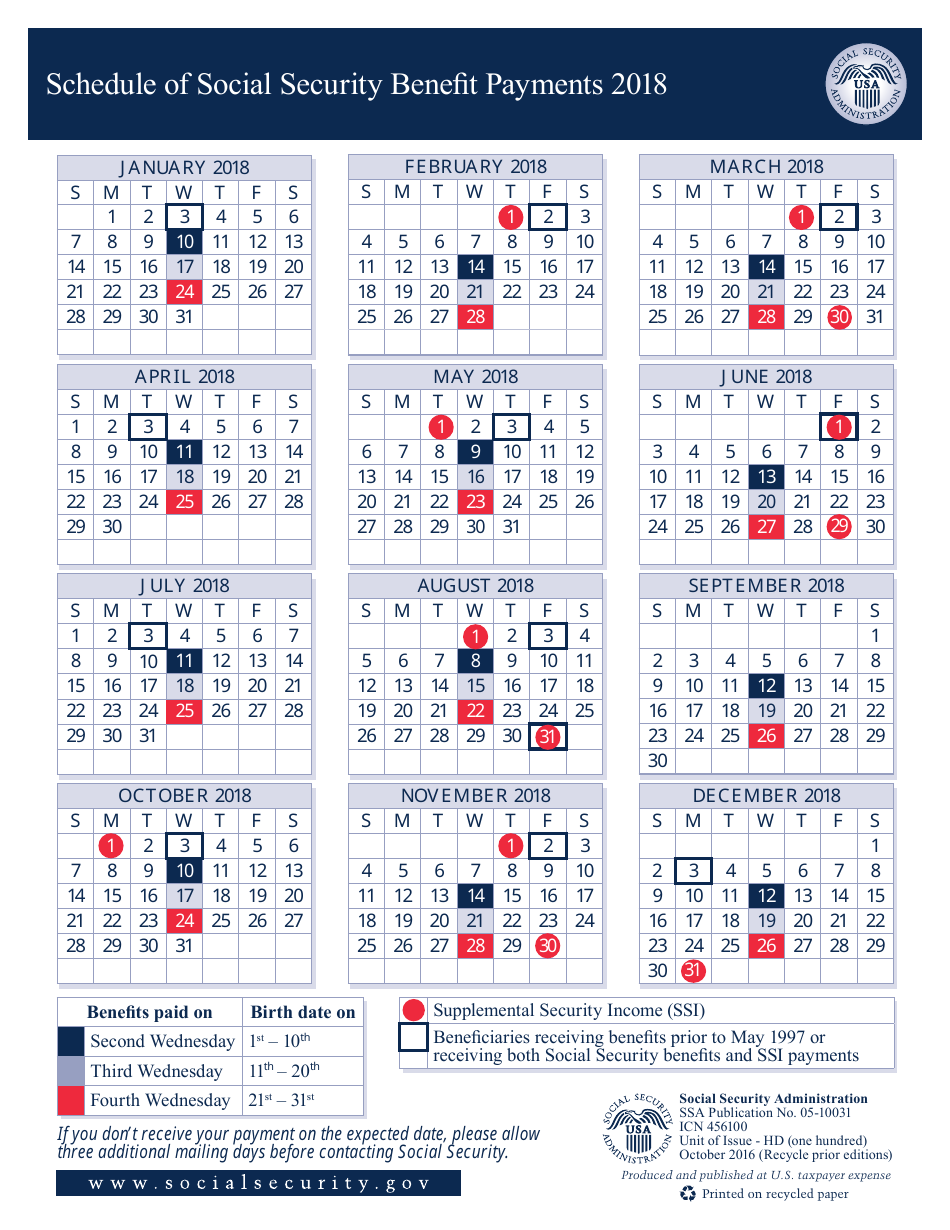

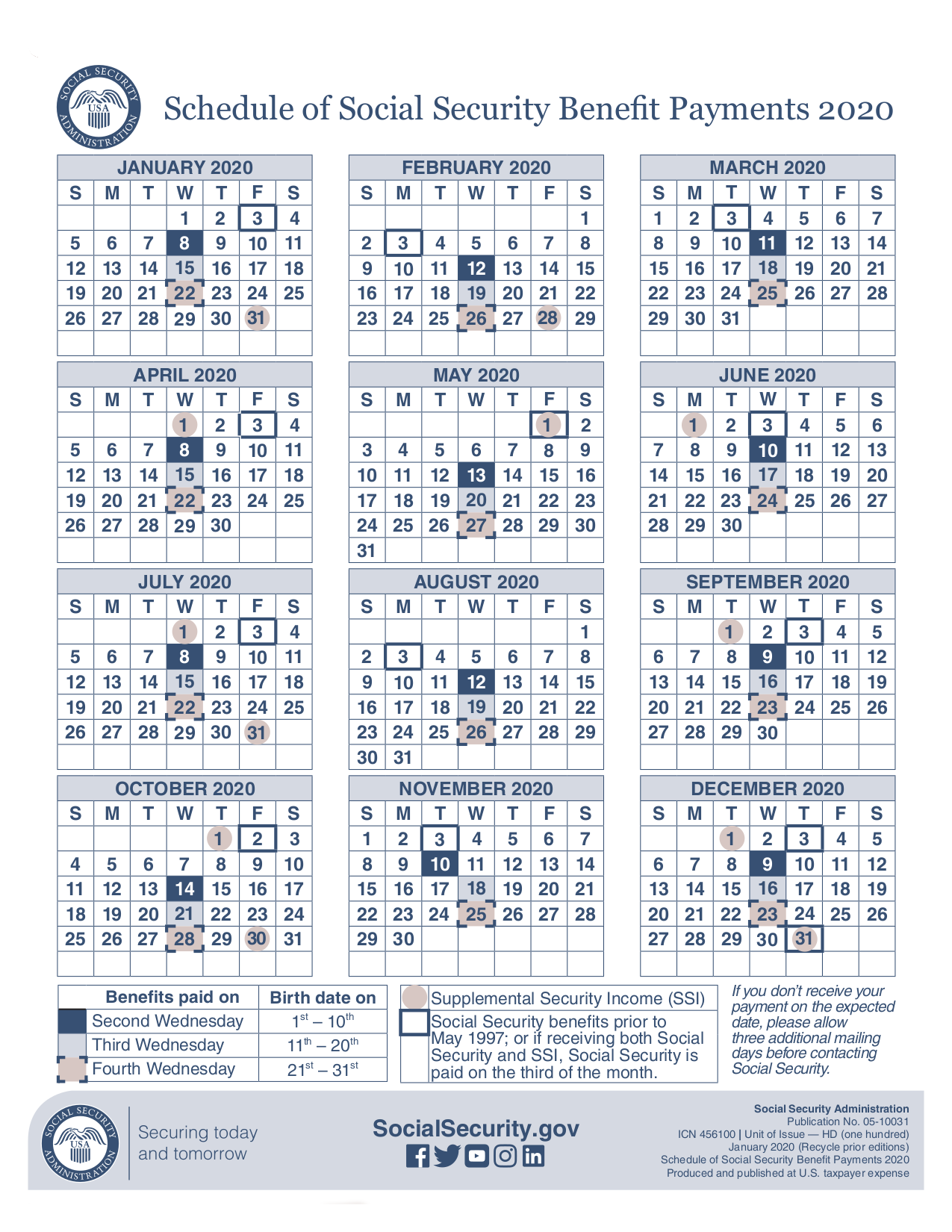

Ssi Ssdi Payment Schedule 2024 Download Billie Valaria For 2024, the monthly sga amount for non blind disability beneficiaries is $1,550 and the monthly sga amount for statutorily blind disability beneficiaries is $2,590. if a disabled individual earns above the sga amount based on their work activity, they generally cannot be considered disabled under social security guidelines. If an individual earns more than sga, then they will not be eligible for disability benefits, generally speaking. in 2024, sga is $1,550.00 for non blind individuals, and $2,590.00 for blind individuals. in 2023, the figures were $1,470.00 and $2,460.00 respectively. these increases are also based on the national average wage index. “countable earnings” of employees indicate sga and “countable income” of the self employed is “substantial” if the amount averages more per month than: in calendar year 2024. $1550. in calendar year 2023. $1470. in calendar year 2022. $1350. in calendar year 2021. $1310. in calendar year 2020. $1260. A person who earns more than a certain monthly amount is considered to be "engaging in sga," and thus not eligible for ssdi benefits. in 2024, the sga amount is $1,550 for disabled applicants and $2,590 for blind applicants. (the sga amount increases a bit each year due to federal regulations that use the national average wage index to set the.

Navigating The 2024 Ssdi Sga Limits What You Need To Know “countable earnings” of employees indicate sga and “countable income” of the self employed is “substantial” if the amount averages more per month than: in calendar year 2024. $1550. in calendar year 2023. $1470. in calendar year 2022. $1350. in calendar year 2021. $1310. in calendar year 2020. $1260. A person who earns more than a certain monthly amount is considered to be "engaging in sga," and thus not eligible for ssdi benefits. in 2024, the sga amount is $1,550 for disabled applicants and $2,590 for blind applicants. (the sga amount increases a bit each year due to federal regulations that use the national average wage index to set the. What is substantial gainful activity? substantial gainful activity is generally work that brings in over a certain dollar amount per month. in 2023, the sga amount is $1,470 for disabled ssdi or ssi applicants and $2,460 for blind ssdi applicants (note that the sga limit doesn't apply to blind ssi applicants). (social security 2023.). For 2024, the amount of earnings that will have no effect on eligibility or benefits for ssi beneficiaries who are students under age 22 is $9,230 a year. the amount of earnings that we can exclude each month, until we have excluded the maximum for the year, is $2,290 a month. details on the seie are on student earned income exclusion.

Ssi Disability Payment Schedule 2024 Download Cate Marysa What is substantial gainful activity? substantial gainful activity is generally work that brings in over a certain dollar amount per month. in 2023, the sga amount is $1,470 for disabled ssdi or ssi applicants and $2,460 for blind ssdi applicants (note that the sga limit doesn't apply to blind ssi applicants). (social security 2023.). For 2024, the amount of earnings that will have no effect on eligibility or benefits for ssi beneficiaries who are students under age 22 is $9,230 a year. the amount of earnings that we can exclude each month, until we have excluded the maximum for the year, is $2,290 a month. details on the seie are on student earned income exclusion.

Ssdi Wage Limit 2024 Ciel Melina

Comments are closed.