What Is Wage Garnishment How Can You Avoid It Nancyrubin

What Is Wage Garnishment How Can You Avoid It Nancyrubin You could file a consumer proposal. you could also file for personal bankruptcy. both of these legal actions can put an immediate stop to the garnishing of wages. however, it is important that you act quickly. the sooner you take advantage of court protection, the sooner you can stop the garnishee from taking your money. Here’s how that breaks down: • if your weekly disposable income is $290 or more, a maximum of 25% is taken. • if it's between $289.99 and $217.51, the amount above $217.51 can be taken.

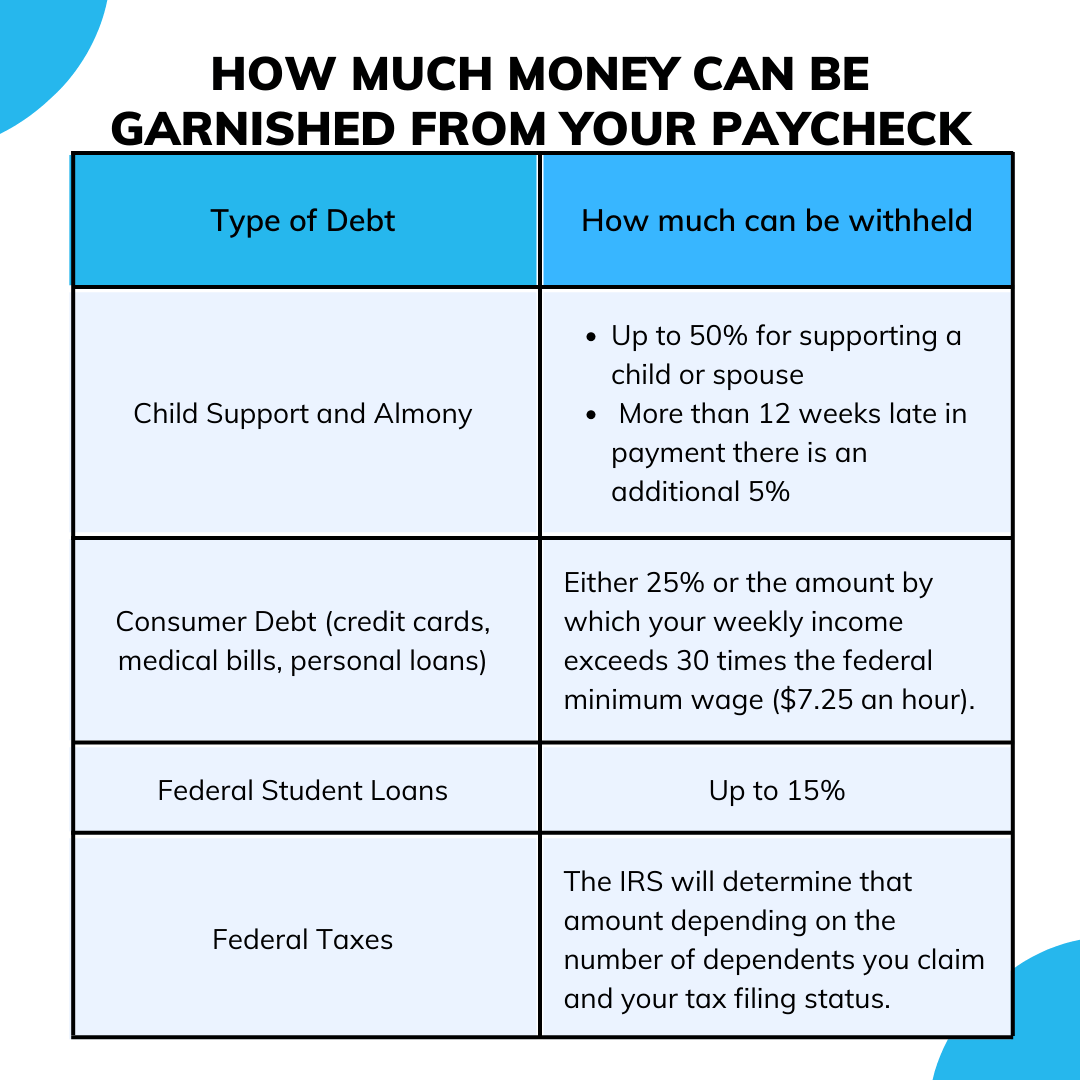

Wage Garnishment How It Works And What You Can Do Stps Wage garnishment is a legal procedure in which an employer is required to withhold a portion of an employee’s wages as payment for outstanding debt. while the process is typically initiated by a. Wage garnishment is a method of debt collection in which part of your earnings are withheld each pay period and used to pay back your creditors. wage garnishment can affect both private debts, such as a delinquent loan or credit card bill, and public debt, such as taxes owed to the government. wage garnishment is a legal process that usually. Actually, it's an omen. your financial life is a mess," he says. "in fact, wage garnishment means you can't be trusted to pay what you owe, so someone else is seizing your paycheck to make sure. If your weekly pay period is $1,256.66 or more; 25% maximum of disposable earnings. however, some states may have different limits. for example, if you can argue your case in front of a court, they may reduce your wage garnishment percentage to 10% of your disposable earnings instead of 25%. wage garnishments can also apply to other sources of.

What Is Wage Garnishment Paycheck Penalties Explained Actually, it's an omen. your financial life is a mess," he says. "in fact, wage garnishment means you can't be trusted to pay what you owe, so someone else is seizing your paycheck to make sure. If your weekly pay period is $1,256.66 or more; 25% maximum of disposable earnings. however, some states may have different limits. for example, if you can argue your case in front of a court, they may reduce your wage garnishment percentage to 10% of your disposable earnings instead of 25%. wage garnishments can also apply to other sources of. How to stop a wage garnishment. usually, you have the right to written notice and a hearing before your employer starts holding back some of your wages to pay your judgment creditor. typically, that notice is in the form of a "notice of garnishment of personal earnings" or a similar document that the court sends you. get debt relief now. Some of the ways to lower—or even eliminate—the amount of a wage garnishment include: filing a claim of exemption. filing for bankruptcy, or. vacating the underlying money judgment. read on to learn more about these options. get debt relief now. we've helped 205 clients find attorneys today. first name.

Comments are closed.