What Percent Of Your Income Should You Invest With Data

What Percentage Of Your Income Should You Be Investing Invest Invest 20% of your income for long term goals like retirement. so when it comes to how much you should invest, according to this rule, you should aim to invest 20% of your income. if your income level doesn’t allow for big lump sum contributions to your investment accounts, consider employing a micro investing strategy. The sweet spot, according to experts, seems to be 15% of your pretax income. matt rogers, a cfp and director of financial planning at emoney advisor, refers to the 50 15 5 rule as a guideline for.

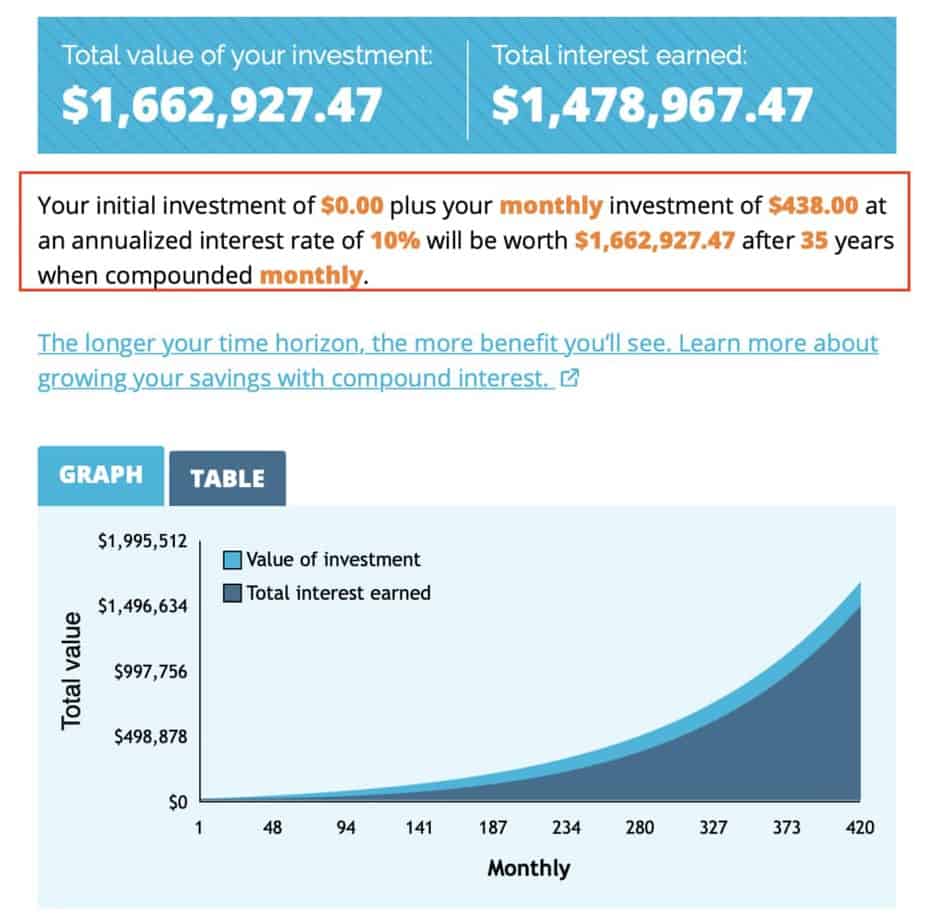

What Percentage Of Your Income Should You Invest By Salary Many of the experts we spoke with suggested, as a general rule, to invest a set percentage of your after tax income. although that percentage can vary depending on your income, savings, and debts. Simply divide your income number by 4.5%, or 0.045. if you need your savings to generate $70,000 in annual retirement income, for example, you'd aim to amass at least $1,555,556 in your retirement. Use the investment calculator to determine: how much an initial investment will grow over time. how much you’ll need to invest now to retire. the amount you should contribute to retirement each year, even if you’re starting to invest later in life. how much to invest per month to reach a future financial goal. Your investment portfolio allocation should align with your financial goals. this percentage split would represent an income data for u.s. stocks is from.

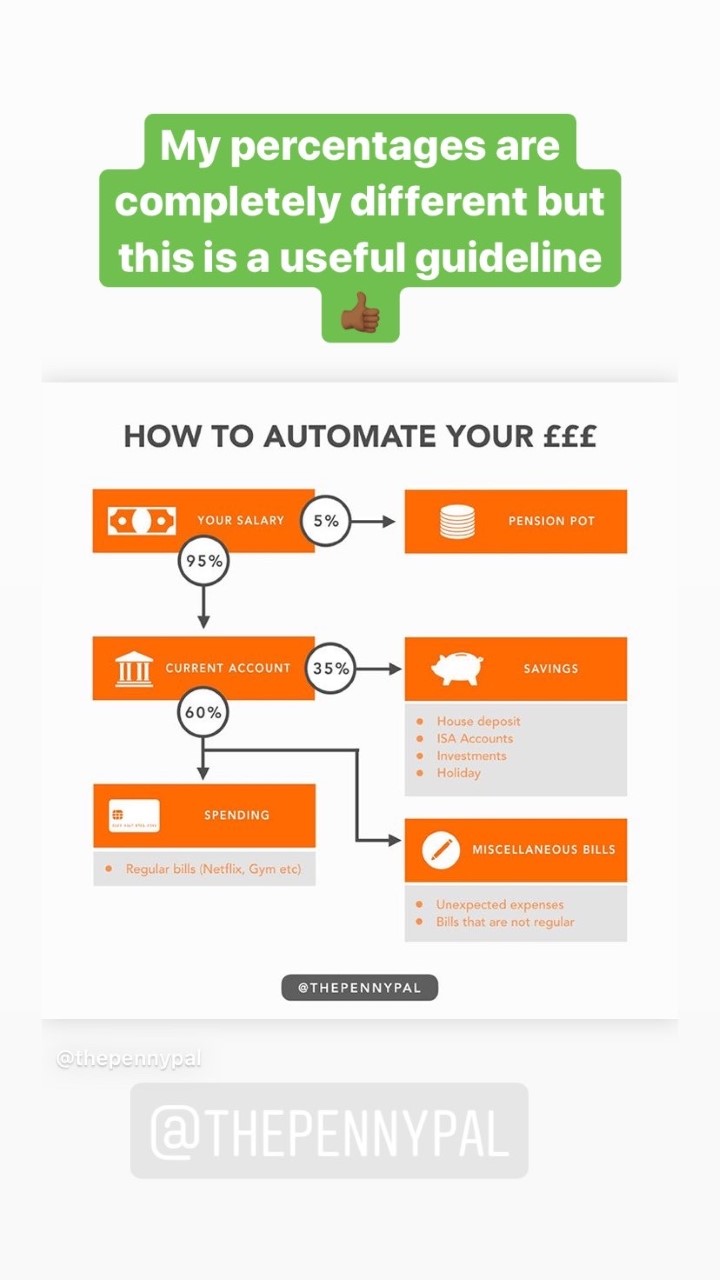

What Percentage Of Your Income Should You Invest By Salary Range Use the investment calculator to determine: how much an initial investment will grow over time. how much you’ll need to invest now to retire. the amount you should contribute to retirement each year, even if you’re starting to invest later in life. how much to invest per month to reach a future financial goal. Your investment portfolio allocation should align with your financial goals. this percentage split would represent an income data for u.s. stocks is from. A common rule of thumb is the 50 30 20 rule, which suggests allocating 50% of your after tax income to essentials, 30% to discretionary spending and 20% to savings and investments. within that 20% allocation, the portion designated for stocks depends on your risk tolerance. if you’re risk averse, you may prefer a conservative approach. A savings goal of $500 a month amounts to 12% of your income, which is considered an appropriate amount for that income level. assuming your income increases by an average of 4% per year, this.

What Percentage Of Your Income Should You Be Investing Invest A common rule of thumb is the 50 30 20 rule, which suggests allocating 50% of your after tax income to essentials, 30% to discretionary spending and 20% to savings and investments. within that 20% allocation, the portion designated for stocks depends on your risk tolerance. if you’re risk averse, you may prefer a conservative approach. A savings goal of $500 a month amounts to 12% of your income, which is considered an appropriate amount for that income level. assuming your income increases by an average of 4% per year, this.

Comments are closed.