What Proof To Put In Your Fcra Letter To The Bureaus Equifax Experian Transunion Etc

What Proof To Put In Your Fcra Letter To The Bureaus Equifaxо Few suggestions when you are doing your dispute letters to the credit reporting agencies to fix errors.i mentioned about using a screen recorder if doing onl. Here is a brief summary of the rights designed to help you recover from identity theft. 1. you have the right to ask that nationwide consumer reporting agencies place “fraud alerts” in your file to let potential creditors and others know that you may be a victim of identity theft.

A Guide To The 3 Credit Bureaus Equifax Experian And Transunion P.o. box 9554. allen, tx 75013. transunion fraud alert. 800 680 7289. transunion fraud victim assistance dept. p.o. box 2000. chester, pa 19016. when you reach out to the credit bureaus, you’ll want to place a fraud alert on your credit report to let creditors and lenders know your personal information may have been compromised. A 611 dispute letter is a written communication that you can physically send to a creditor or any of the 3 credit reporting bureaus. by law, these disputes must each be given an appropriate level of investigation in an attempt to confirm their legitimacy. once a dispute is received, it must be investigated and decided upon within 30 days. The nation’s three largest credit bureaus—equifax, experian, and transunion— said this week that they would make permanent consumers’ access to free, weekly credit reports via. The three major credit bureaus are equifax, experian and transunion. the credit bureaus manage records on your accounts, balances and the payments you make. each credit bureau operates.

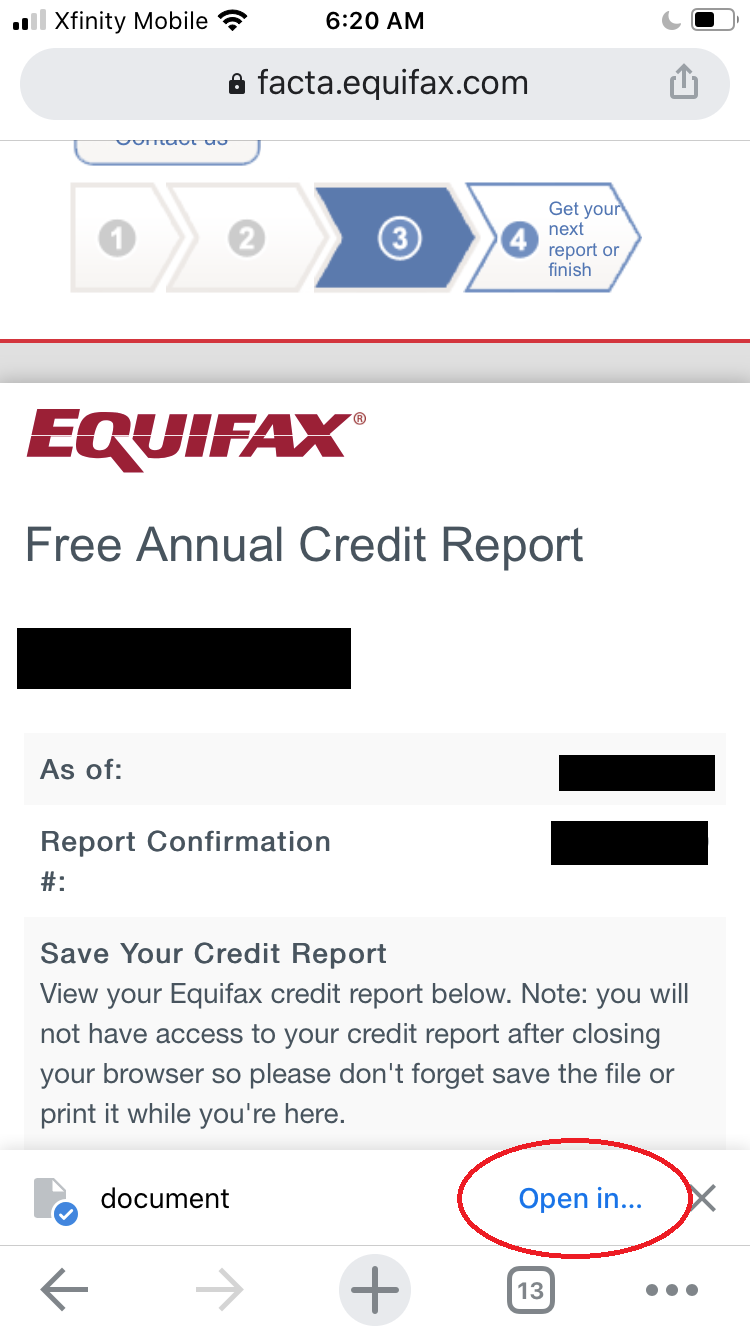

Step By Step Guide To Downloading And Sending Your Free Credit Report The nation’s three largest credit bureaus—equifax, experian, and transunion— said this week that they would make permanent consumers’ access to free, weekly credit reports via. The three major credit bureaus are equifax, experian and transunion. the credit bureaus manage records on your accounts, balances and the payments you make. each credit bureau operates. The big three: equifax, experian, transunion. equifax, experian, and transunion are the 3 main credit bureaus in the us. they each collect and maintain a record of your credit history, with details like your borrowing habits, payment history, and overall credit utilization. they all gather similar types of information, but there can be big. The fair credit reporting act limits who can access your credit report and for what purpose. potential employers must get your written permission before accessing your credit reports. credit bureaus must remove your name from marketing lists if you ask. when you apply for things like a new credit card, a mortgage or an apartment, the companies.

Comments are closed.