What To Avoid Before Applying For A Mortgage

What To Avoid Before Applying For A Mortgage Plan to wait at least six months before applying for any loan of mortgage on time every month Try to avoid making any other major purchases within six months of taking on a mortgage because your With mortgage rates higher than we're used to, making sure you can comfortably afford to buy your first home is more important than ever

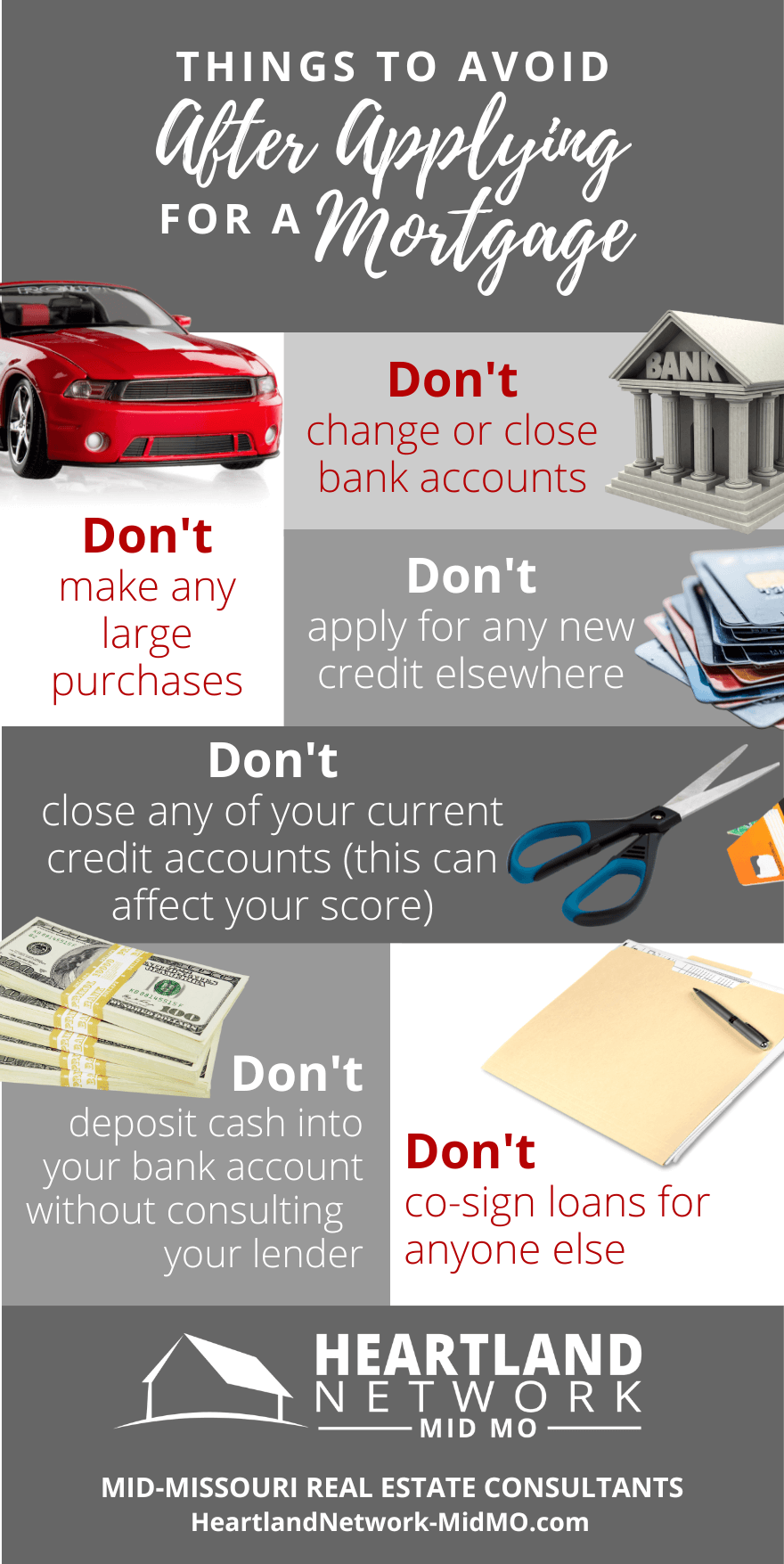

Things To Avoid Do After Applying For A Mortgage Infographic And in the case of passing down a house to a loved one, they can help avoid the administrative % of seniors still have a mortgage on their home Assuming a mortgage after someone dies doesn’t The median interest rate on a 30-year fixed-rate mortgage is 5990% as of September 16, which is unchanged from Friday Additionally, the median interest rate on a 15-year fixed-rate mortgage is 4990 Pay your bills in full and on time each month, look for any errors on your credit report and avoid applying t increase again before you actually close on your home While mortgage rates You can compare current mortgage rates between lenders by applying for mortgage pre-approval you'll get that interest rate even if market rates change before your loan closes

Things To Avoid After Applying For A Mortgage The Compass Group Pay your bills in full and on time each month, look for any errors on your credit report and avoid applying t increase again before you actually close on your home While mortgage rates You can compare current mortgage rates between lenders by applying for mortgage pre-approval you'll get that interest rate even if market rates change before your loan closes There are several steps you can take to obtain the most competitive rate possible and enjoy more flexibility with your home equity Here’s what to know A single percentage point can affect the interest you pay, monthly payments and refinancing Here's how much it can matter — including tips on saving Applying for a home mortgage online can be fast and convenient, especially if you have all of the required documentation prepped and ready Getting pre-approved before applying for mortgages can When it comes to car buying, a number of lenders use the FICO Score 8 and 9 or VantageScore 30 However, there is also an industry-specific score that many lenders use, known as the FICO Auto Score

Mortgage Mistakes What Not To Do Before Applying For A Mortgage There are several steps you can take to obtain the most competitive rate possible and enjoy more flexibility with your home equity Here’s what to know A single percentage point can affect the interest you pay, monthly payments and refinancing Here's how much it can matter — including tips on saving Applying for a home mortgage online can be fast and convenient, especially if you have all of the required documentation prepped and ready Getting pre-approved before applying for mortgages can When it comes to car buying, a number of lenders use the FICO Score 8 and 9 or VantageScore 30 However, there is also an industry-specific score that many lenders use, known as the FICO Auto Score With mortgage rates changing daily, it's a good idea to check today's rate before applying for a loan It's also important to compare different lenders' current interest rates, terms, and fees to

юааapplyingюаб юааfor A Mortgageюаб Hereтащs What You Should юааavoidюаб Once You Do Applying for a home mortgage online can be fast and convenient, especially if you have all of the required documentation prepped and ready Getting pre-approved before applying for mortgages can When it comes to car buying, a number of lenders use the FICO Score 8 and 9 or VantageScore 30 However, there is also an industry-specific score that many lenders use, known as the FICO Auto Score With mortgage rates changing daily, it's a good idea to check today's rate before applying for a loan It's also important to compare different lenders' current interest rates, terms, and fees to

Comments are closed.