Whats The Right Way To Invest 15 Of Your Income

Why Should I Invest 15 Of My Income For Retirement 2024 How to invest money. 1. give your money a goal. figuring out how to invest money starts with determining your investing goals, when you need or want to achieve them and your comfort level with. Here are seven income strategies to consider for your own planning purposes: cash deposits. bonds. preferred stocks. dividend paying stocks. real estate investment trusts (reits). multi asset.

What S The Right Way To Invest 15 Of Your Income Before you start investing, you need to work your way through the first three of ramsey’s 7 baby steps. that means saving $1,000 for a starter emergency fund, paying off all your debt except your mortgage using the debt snowball method, and then saving a fully funded emergency fund of 3–6 months of expenses. Investors can choose to purchase individual bonds or opt for a bond exchange traded fund, such as the ishares core u.s. aggregate bond etf (ticker: agg) or the vanguard total bond market etf (bnd. Here are five steps to start investing this year: 1. start investing as early as possible. investing when you’re young is one of the best ways to see solid returns on your money. that's thanks. 5 best investments for 2024. you can grow your money in many ways — high yield savings accounts, cds, bonds, funds and stocks are all options. the best investment for you depends on your risk.

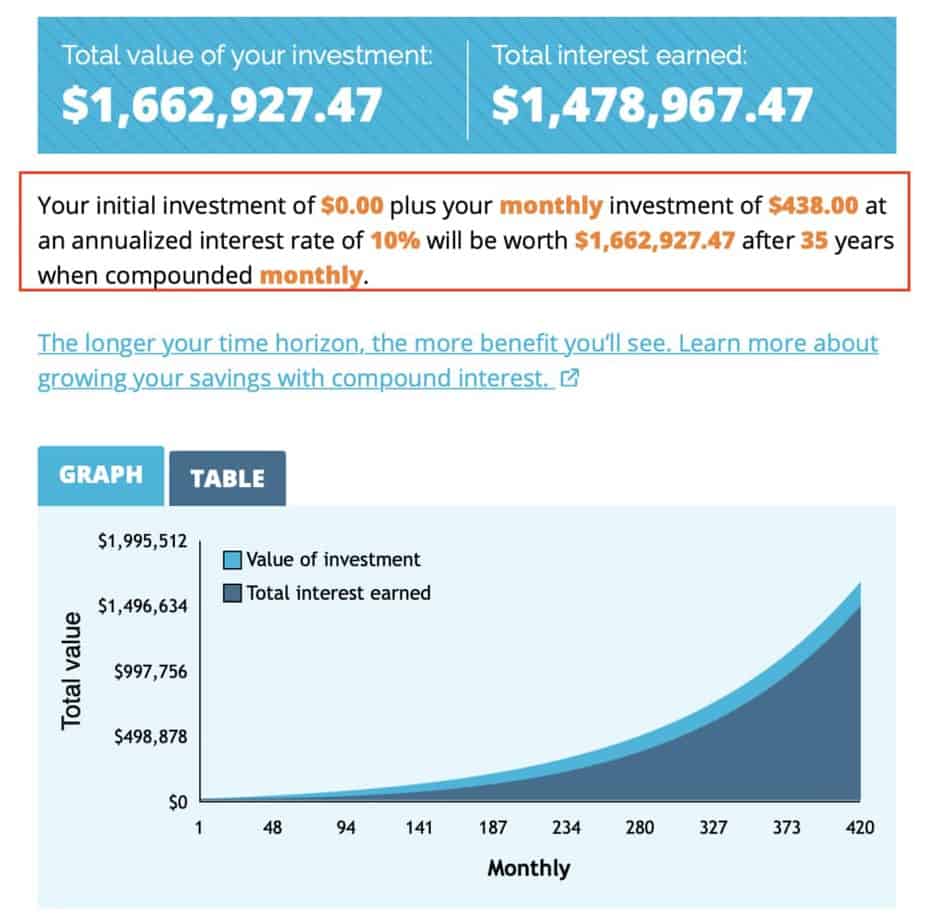

What Percentage Of Your Income Should You Invest By Salary Range Here are five steps to start investing this year: 1. start investing as early as possible. investing when you’re young is one of the best ways to see solid returns on your money. that's thanks. 5 best investments for 2024. you can grow your money in many ways — high yield savings accounts, cds, bonds, funds and stocks are all options. the best investment for you depends on your risk. Think of it this way: the stock market has historically produced returns of 9% to 10% annually over long periods. if you invest your money at these types of returns and pay your creditors 25%. So here are some of the most common ways to invest money. 1. stocks. almost everyone should own stocks or stock based investments like exchange traded funds (etfs) and mutual funds (more on those.

Comments are closed.