Why Irs Recommends To E File 1099 Forms R Tax1099

Why Irs Recommends To E File 1099 Forms R Tax1099 The irs recommends filers to e file form 1099 such as 1099 int, 1099 div and other 1099 forms for quick and safe processing. comments sorted by best top new controversial q&a add a comment. Filers can use the platform to create, upload, edit and view information and download completed copies of 1099 series forms for distribution and verification. with iris, businesses can e file both small and large volumes of 1099 series forms by either keying in the information or uploading a file with the use of a downloadable template.

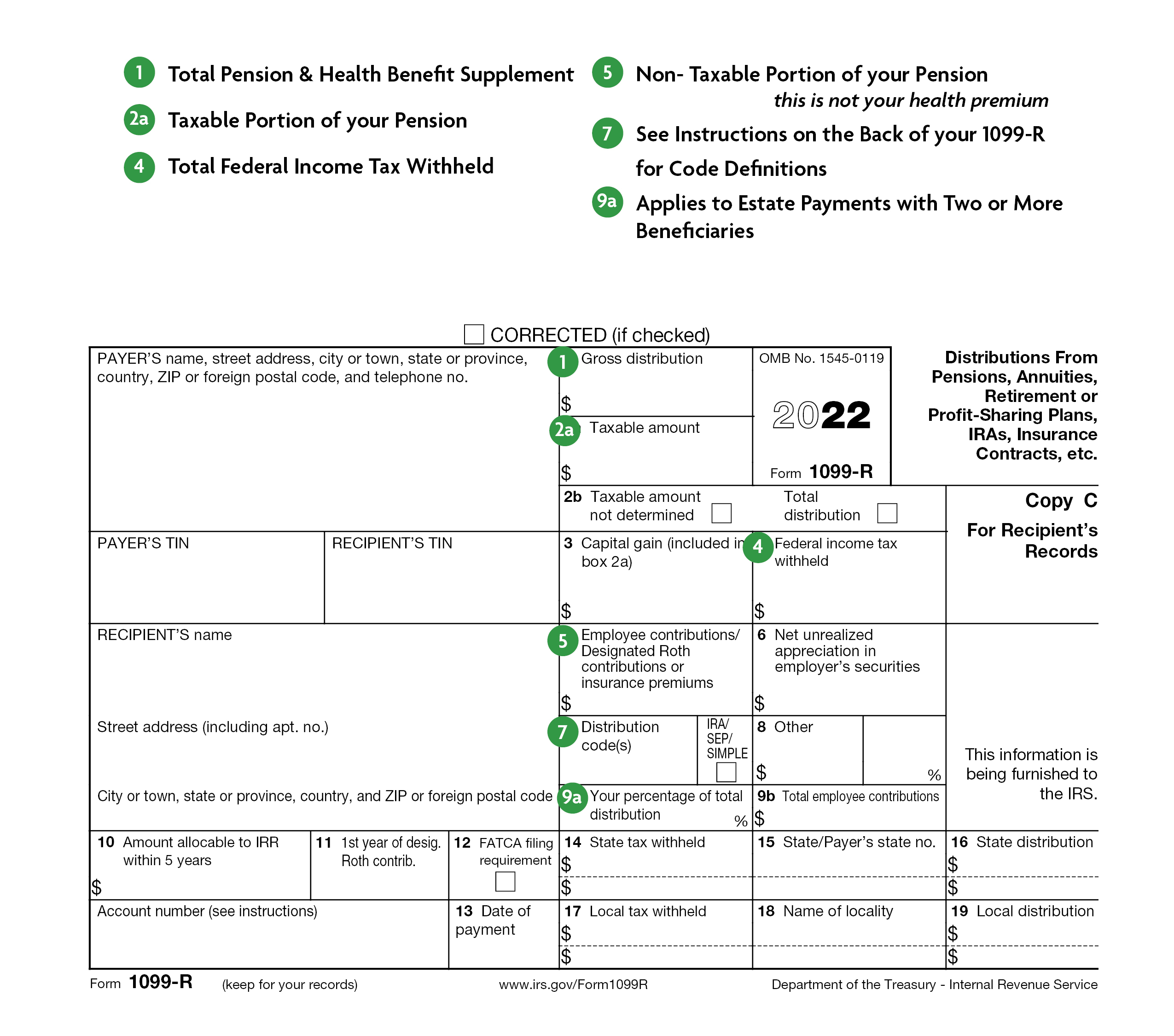

Form 1099 R Instructions Information Community Tax Individual and bulk forms. file direct through the taxpayer portal or use software through iris application to application. tax year 2022 and later: all forms 1099. tax year 2023 (portal only): forms 1097 btc, 1098, 1098 c, 1098 e, 1098 f, 1098 q, 1098 t, 3921, 3922, 5498, 5498 esa, 5498 sa and w 2g. R tax1099. join. hot. hot new top rising. hot new top. rising. the irs recommends filers to e file form 1099 such as 1099 int, 1099 div and other 1099 forms for. Track 1099 lets you correct amend 1099s efiled as many times as you want once you pay them. i could not think of going back to paper filing after using this service. saves so much time. if you’re using qb online, you can file your 1099’s right from inside it, but it doesn’t do state filings. The 3 step process to 10 and 9 series forms efiling. you are just 3 steps away to efile irs forms 1099 nec, 1099 misc, 940, w2 & more. 01. create. select the form, tax year & enter the details. 02. validate. verify the accuracy of the information and proceed.

Selecting The Correct Irs Form 1099 R Box 7 Distribution Codes вђ Ascensus Track 1099 lets you correct amend 1099s efiled as many times as you want once you pay them. i could not think of going back to paper filing after using this service. saves so much time. if you’re using qb online, you can file your 1099’s right from inside it, but it doesn’t do state filings. The 3 step process to 10 and 9 series forms efiling. you are just 3 steps away to efile irs forms 1099 nec, 1099 misc, 940, w2 & more. 01. create. select the form, tax year & enter the details. 02. validate. verify the accuracy of the information and proceed. All business owners must check the deadlines for the different 1099 forms. the due date for filing paper or e filing of form 1099 nec is jan 31. however, the deadlines for paper filing and e filing with the irs of form 1099 misc are feb 28 and mar 31, respectively. to check the due dates of all the 1099s: visit form 1099 deadlines form 1099. That’s why we at tax1099 went the extra mile to develop an ai tax assist to provide you with a stress free efiling experience. zenwork assist is like a 24 7 tax assistant that can effortlessly guide you through every tax filing step, address your queries with expertise, and promptly help you file your 1099, w2, 94x, and 1095 forms.

Understanding Your 1099 R Dallaserf Org All business owners must check the deadlines for the different 1099 forms. the due date for filing paper or e filing of form 1099 nec is jan 31. however, the deadlines for paper filing and e filing with the irs of form 1099 misc are feb 28 and mar 31, respectively. to check the due dates of all the 1099s: visit form 1099 deadlines form 1099. That’s why we at tax1099 went the extra mile to develop an ai tax assist to provide you with a stress free efiling experience. zenwork assist is like a 24 7 tax assistant that can effortlessly guide you through every tax filing step, address your queries with expertise, and promptly help you file your 1099, w2, 94x, and 1095 forms.

Comments are closed.