Why Is Life Insurance So Important Fidelity Life

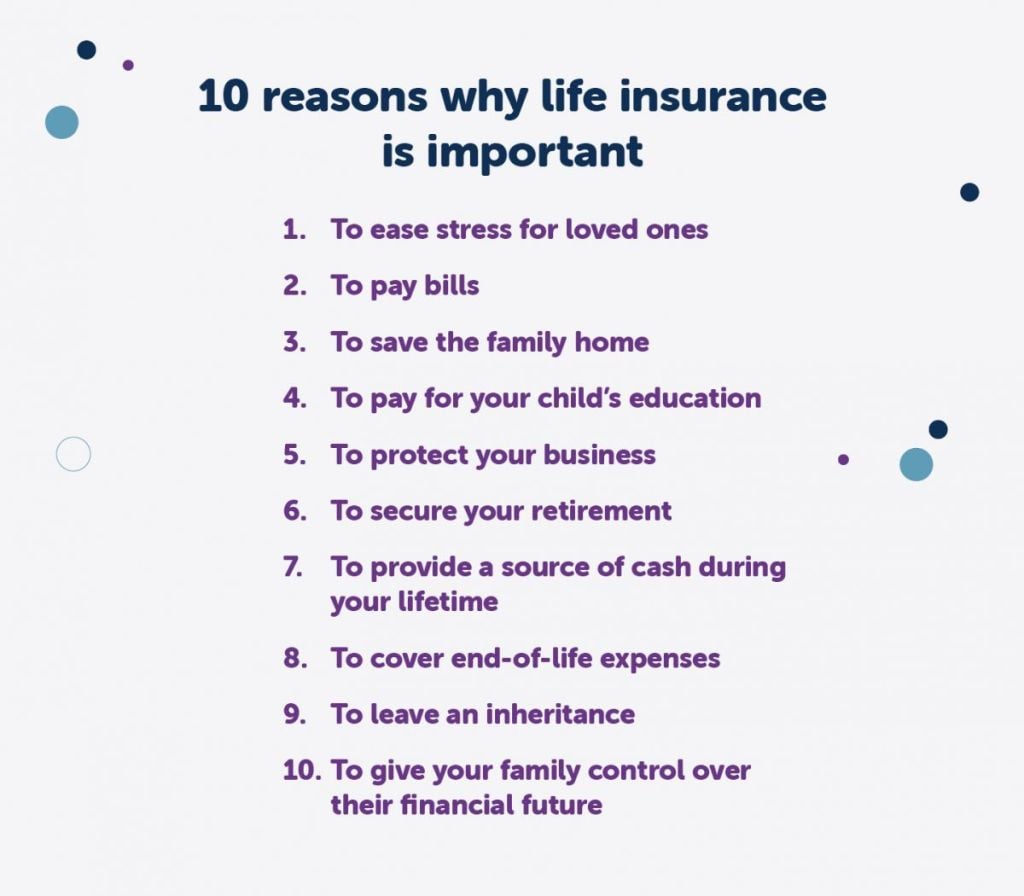

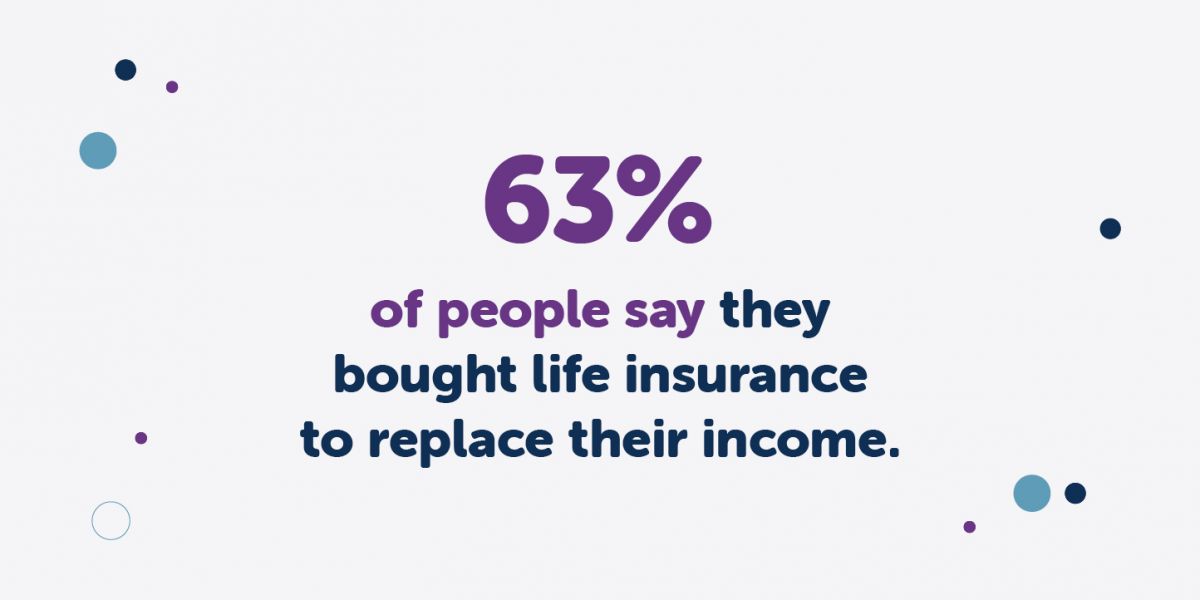

Why Is Life Insurance So Important Fidelity Life But they don’t have to. this is one of the biggest reasons life insurance is important. life insurance is designed to provide your loved ones with financial support after your death – support that can act as an income replacement should it be needed. when you purchase life insurance, you choose a coverage amount. The truth is that a healthy 30 year old woman can have $250,000 in coverage for only $15.01 monthly. term life insurance cost does vary depending on your individual profile. some factors that can influence the cost of your policy are: typically, term life insurance is the most economical type of coverage.

Why Is Life Insurance So Important Fidelity Life Fidelity life term life insurance is simple and easy to understand. it is cost effective, dependable, and tailored to your financial needs. the terms are flexible, and you can choose the lengths from 10, 15, 20, up to 30 years. the coverage amounts range from $50,000 to $2,000,000. final expense. 6. no medical exam: pros. offers a variety of term and whole life policies. term life policies available for 10 to 30 years. may not have to take a medical exam for coverage. cons. maximum. First, calculate your family's day to day needs—the entire amount of money it takes to run your household each month. next, plan for larger expenses such as college, paying off student loans, a mortgage, or potential medical issues. one simple guideline is to aim for 10 12 times your annual salary and bonus. Chicago, nov. 24, 2021 (globe newswire) when people are young and healthy, taking out a life insurance policy may seem unnecessary. but as people get older and take on more responsibility, the.

8 Things You Should Know About Life Insurance Fidelity Life First, calculate your family's day to day needs—the entire amount of money it takes to run your household each month. next, plan for larger expenses such as college, paying off student loans, a mortgage, or potential medical issues. one simple guideline is to aim for 10 12 times your annual salary and bonus. Chicago, nov. 24, 2021 (globe newswire) when people are young and healthy, taking out a life insurance policy may seem unnecessary. but as people get older and take on more responsibility, the. Fidelity brokerage services llc, member nyse, sipc, 900 salem street, smithfield, ri 02917. 1050266.6.0. term life insurance from fidelity is designed to provide financial resources to your family in the event of your death. learn which coverage options fit your needs here. The decision to purchase life insurance should be based on long term financial goals and the need for a death benefit. life insurance is not an appropriate vehicle for short term savings or short term investment strategies. surrender charges apply for the first 19 years of the policy, which may decrease the policy surrender value substantially.

8 Need To Know Life Insurance Facts Fidelity Life Fidelity brokerage services llc, member nyse, sipc, 900 salem street, smithfield, ri 02917. 1050266.6.0. term life insurance from fidelity is designed to provide financial resources to your family in the event of your death. learn which coverage options fit your needs here. The decision to purchase life insurance should be based on long term financial goals and the need for a death benefit. life insurance is not an appropriate vehicle for short term savings or short term investment strategies. surrender charges apply for the first 19 years of the policy, which may decrease the policy surrender value substantially.

Comments are closed.