Wire Transfer Fraud Three Simple Steps To Preventing Digital Frauds

Wire Transfer Fraud Three Simple Steps To Preventing Digital Frauds Wire transfer fraud three steps to prevent it👋 hello business leaders,welcome to another video brought to you by the coyle group, your trusted partner in. How to avoid wire transfer fraud. now you know what wire transfer fraud looks like, let’s explore the best ways to prevent it. be aware of the risks. you and your team should take the time to understand exactly how fraudsters gain your confidence and the tactics they use to scam you into complying with their requests.

How To Prevent Wire Transfer Fraud Cloudsmart It Signs of a wire transfer scam. fake wire fraud scams are relatively easy to spot if you know what to look for. here are some of the most common signs. sign #1: someone suddenly asks you for money. an unexpected payment request could be a major red flag—even if it seems to be from a loved one or colleague. A wire transfer scam is a type of bank fraud that involves electronic communication, rather than a face to face bank transfer. by sending your money electronically, it can be easier for scammers to encourage you to make a fraudulent transfer. a scammer may get access to your bank details or they may ask you for money under false pretenses. Tip 3: don’t be rushed. go slow and be prudent with all unexpected communications. scammers often employ tactics like impersonating legitimate institutions or individuals to trick you into making wire transfers. they may even use caller id so that their phone calls appear to be coming from a legitimate source. 2. overpayment scams on online marketplaces. in this scam, fake buyers claim they accidentally sent too much money via wire transfer and ask you to return the difference. if you do this, the scammers will rescind their initial payment, leaving you out of pocket.

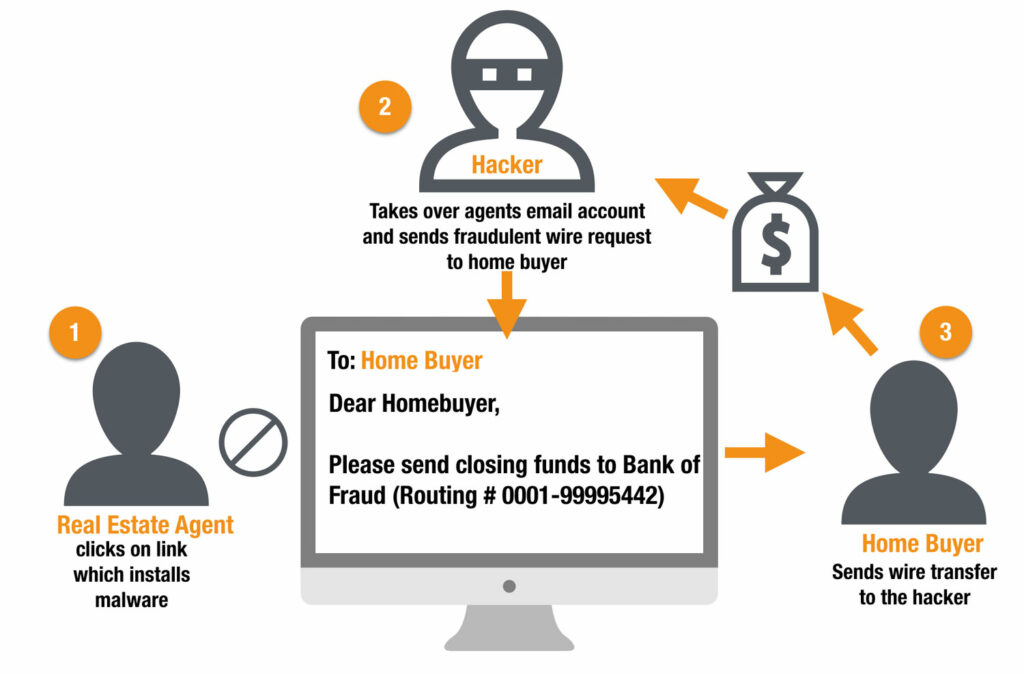

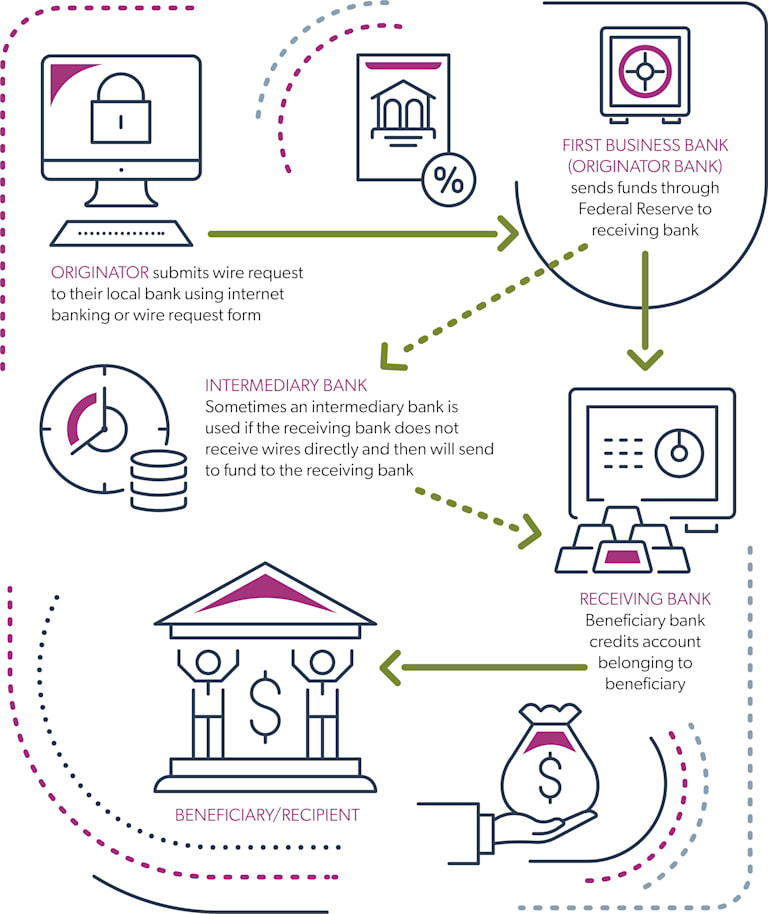

Best Practices For Wire Transfer Fraud Prevention First Business Bank Tip 3: don’t be rushed. go slow and be prudent with all unexpected communications. scammers often employ tactics like impersonating legitimate institutions or individuals to trick you into making wire transfers. they may even use caller id so that their phone calls appear to be coming from a legitimate source. 2. overpayment scams on online marketplaces. in this scam, fake buyers claim they accidentally sent too much money via wire transfer and ask you to return the difference. if you do this, the scammers will rescind their initial payment, leaving you out of pocket. What constitutes wire transfer fraud and steps for prevention fraud losses are growing at an all time high, keeping financial institutions and their clients on their toes. in fact, the federal bureau of investigation's 2023 ic3 report reveals that a record number of complaints were received in 2023 at 880,418, with potential losses exceeding $12.5 billion. Wire transfer fraud business email compromise. wire transfer fraud is a scam where criminals use social engineering techniques and other deceptive practices to convince organizations to initiate wire transfers. deceptive email domains or the compromised accounts of senior executives are often used to send fraudulent invoices to those within.

Comments are closed.